полная версия

полная версияThe Continental Monthly, Vol. 4, No. 4, October, 1863

Had this principle been adopted in the United States at the same period, the excesses and extravagance of 1856-'7 might have been obviated, as well as the revulsion of the latter year, and the distress which followed.

Let us recur to the eventful history of the bank. Although a private institution, owned and controlled by private capital, its large profits accruing for the benefit of its own share-holders, yet it became so closely inter-woven with the commerce, manufactures, trade, and the public finances of the nation, that it may be considered as in reality a national institution. At its inception its whole capital was swallowed by the treasury. This was a part of the contract of charter. Its subsequent accumulations of capital, from £1,200,000, have likewise been absorbed by the Government, until now the bank reports the Government debt to them to be £11,015,100, and the Government securities held, to be £11,064,000. Without the aid of the bank, the national treasury could not, probably, have made the enormous disbursements which were actually made between the commencement of the American Revolution in 1776, and the termination of the continental war of 1815. The bank here furnished, almost alone, 'the sinews of war.'

During this eventful period there were large numbers of provincial banks of issue created in England and Ireland. These were managed mainly with a view to private profit, while the public interests have suffered severely from the frequent expansions and contractions of the volume of the currency through such private management, and from the numerous failures of these concerns. The evils of this system were for many years the subject of discussion in Parliament and among prominent journals. In 1826 the Edinburgh Review expressed the opinion that

'So long, therefore, as any individual, or association of individuals, may issue notes of a low value, to be used in the common transactions of life, without lodging any security for their ultimate payment, so long is it certain that those panics which must necessarily occur every now and then, and against which no effectual precaution can be devised, must occasion the destruction of a greater or smaller number of banking establishments, and by consequence a ruinous fluctuation in the supply and value of money.' (Edinburgh Review, February, 1826.)

This was a period of great speculation in England. In the year 1823 no less than 532 companies were chartered, with a nominal capital of 441 millions sterling. These speculations were fostered by the increasing volume of bank paper. The evil increased, and was allowed to exist until the year 1844, when a stop was put to the further increase of the volume of bank circulation, and to the further incorporation of joint stock banks.

We learn one lesson here, which may have a good effect upon us if we will bear it in mind in our future legislation, and take warning from the experiences of our contemporaries. We allude to the obvious necessity in a country like ours, and, indeed, in any country, of maintaining a national moneyed institution as a check upon the vacillation, expansions, and contractions which mark the policy of small banks of issue. This national institution, while free from individual profit, and without power to grant individual favors, should create and perform the functions of a national currency, and execute all the details required by or for the national treasury. Its chief utility would be as a check upon the excess to which all joint stock banks are liable—a sort of controlling and conservative power to prevent that mischief which our past experience shows has been the result of paper money when issued merely for private gain.

The advantage, the convenience, we may say the necessity, of a national circulation of paper money, are fully demonstrated by our own past history, and by the history of European nations. This circulation should be dictated by the wants of the National Government, and convertible, at the will of the holder, into specie. With these obvious restraints it would accomplish its ends and aims.

The Bank of England, in its early stages, was endangered by various and extraordinary circumstances. Within three years of its establishment it was compelled to suspend payment to its depositors in cash, and issued certificates therefor payable ten per cent. every fortnight. In 1709 the Sacheverell riots occurred in London, and fears were felt that the bank would be sacked; but this violence was obviated by well-trained troops. In 1718 John Law's bank was established in France, and for two years kept the people in a ferment. This was followed by the South Sea scheme in England, in 1720, 'a year (the historian Anderson says) remarkable beyond any other which can be pitched upon for extraordinary and romantic projects.' The bank, of course, suffered by these speculative measures, and was repeatedly exposed to a run upon its specie resources.

In 1722 the rest (or reserve fund) was established by the bank, as a measure to cover extraordinary losses in the future, and to inspire more confidence among the public as to the ability of the bank to meet reverses. This fund, in July, 1862, had accumulated to £3,132,500 sterling, or about twenty-one and a half per cent. of the capital.

The first forged note of the Bank of England was presented in the year 1758, or sixty-four years after the bank was established. In 1780 these forgeries became more numerous, and were so well executed as to deceive the officers of the bank.

Let us now recur to some of the incidents connected with the bank in early ages. Of these, the author, Mr. Francis, furnishes numerous instances.

Among other frauds upon the bank was that of clipping the guineas, by one of the clerks employed in the bullion office. This occurred in 1767.

The forgery of its notes having been made a capital offence, the waste of life in consequence was severe. During the eight years, 1795 to 1803, there were one hundred and forty executions for this crime; and two hundred and nine between 1795 and 1809; and from 1797 to 1811 the executions were 469. 'The visible connection between the issue of small notes and the effusion of blood, is one of the most frightful parts of this case.'

In 1803 a fraud on the bank to the extent of £320,000 was perpetrated by Mr. Robert Astlett, a cashier of the bank. This was in the re-issue of exchequer bills that had been previously redeemed, but which were not cancelled. This fraud amounted to about 2-1/2 per cent. of the capital, and although it did not prevent a dividend, it prevented the distribution of a bonus which would otherwise have been paid to the shareholders.

In the year 1822 another fraud on the bank came to light. This was perpetrated by a bookkeeper, and amounted to £10,000. In 1824 the fraud of Mr. Fauntleroy on the bank was discovered, amounting to £360,000. This was done by forged powers of attorney for the transfer of Government consols.

The bank was brought near suspension again in 1825 by the imprudent expansion of its notes. After the resumption of specie payments in 1820-'21, the true policy of the bank would have been to maintain an even tenor of its way; instead of which it increased its circulation twenty-five per cent. in the year 1825 (or from £18,292,000 to £25,709,000), while the issues of the country banks were equally enlarged, giving encouragement to violent speculation among the people. The specie reserve of the Bank of England fell from £14,200,000 in January 1824 to £1,024,000 in December, 1825. This difficulty of the bank was relieved by the issue of a few thousand bills of £1 and £2.

Speculation had been rife in 1824; no less than 624 companies were started with a nominal capital of £372,000,000, including mining, gas, insurance, railroad, steam, building, trading, provision, and other companies. At the same time foreign loans were contracted in England to the extent of £32,000,000, of which over three fourths were advanced in cash.

The country banks of England had increased their circulation from £9,920,000 in 1823 to £14,980,000 in 1825, or over fifty per cent., thus stimulating prices, and promoting speculation widely throughout the country.

Immediately following the revulsion at the close of the year 1825, Mr. Huskisson's free trade policy was advocated in the House of Commons by a vote of 223 to 40. In the same year lotteries were suppressed in England. In 1828 branches of the Bank of England were established—a measure, of course, unpopular among the provincial joint stock banks.

In the year 1832-'3 were brought forward three important measures in Parliament. One was the abolishment of the death penalty for forgery; another was the modification of the usury laws; the third was the re-charter of the bank.

The last criminal executed for forgery was a man by the name of Maynard, in December, 1829. Public sentiment had long been opposed to the infliction of this punishment for the offence of forgery, and transportation was now substituted in the prominent cases. England, at the same time, opened the way for a gradual abolishment of the usury laws. At first the relief was extended to short commercial paper, afterward to all paper having not over twelve months to run, 1837; and finally, in 1854, the usury laws were removed from all negotiable paper, as well as from bonds and mortgages.

By the new charter of 1833, Bank of England notes were, for the first time, made a legal tender, except at the bank itself. Joint stock banks were authorized in the metropolis, but were prohibited from issuing notes.

The English work of Mr. Francis is anecdotical in its character. The American edition conveys to the reader, for the first time, a resumé of the leading movements in Parliament on the subject of the bank, and its close connection with the Government finances. The part which Mr. Pitt, Mr. Canning, Sir Robert Peel, and other distinguished statesmen took in the relations between the bank and the exchequer, is in the supplementary portion of the new edition shown, as well as the views of Lord Althorpe, Lord Ashburton, Lord Geo. Bentinck, Mr. Thomas Baring, Lord Brougham, Mr. Gilbart, Sir James Graham, Lord King, Earl of Liverpool, Jones Loyd, Lord Lyndhurst, Mr. Rothschild, and others who exercised a large influence over the monetary interests of their day.

In the consideration of the banking and currency questions of the day and of the last and present century, it is desirable to have thus brought together in a single work, a continuous history of the institution which has had so large an influence upon the public interests of Europe, and a review of the important circumstances which marked the progress of the bank in its successful efforts to sustain England against foreign enemies and domestic revulsions, an index to the speculative movements of the eighteenth and nineteenth centuries, when commerce, trade, and the vast monetary interests of Europe and America have been unnecessarily and cruelly involved.

The letter addressed by Secretary Chase, of the Treasury Department, to the chairman of the Committee of Ways and Means of the House of Representatives, and to the chairman of the Senate Committee on Finance, under date June 7th, 1862, suggested the power by Congress to the treasury to issue $150,000,000 in treasury notes, in addition to this sum, authorized by the act of February 25th, 1862; also, authority to receive fifty millions of dollars on deposit, in addition to fifty millions previously authorized by Congress. These suggestions were favorably considered in both Houses, and the recommendations of the Secretary were adopted fully, leading to the adoption of a national system of finance, which will eventually reëstablish and preserve national credit. Fears have been expressed in some quarters that this increased volume of paper money would be a public evil, and serve to disturb the value of property and the price of labor. This might be reasonably anticipated if the country were at peace, and the Government expenditures were upon a peace footing.

But a state of things exists now in this country hitherto unknown. The contracts of the Government involve the expenditure of larger sums than were ever paid before in the same space of time by this or any other Government. In the disbursements of these large sums it is an obvious duty of Congress to provide a national circulation of uniform value throughout the whole country—a circulation of a perfectly reliable character, not subject in the least to the ordinary vicissitudes of trade or to the revulsions which have frequently marked our history. These revulsions have been witnessed, and their results seen by the leading public men of the century. Mr. Madison saw at an early day the importance of creating and sustaining a government circulation. His language was: 'It is essential to every modification of the finances that the benefits of an uniform national currency should be restored to the community.'

Mr. Calhoun, in 1816, said: 'By a sort of undercurrent, the power of Congress to regulate the money of the country has caved in, and upon its ruin have sprung up those institutions which now exercise the right of making money in and for the United States.'

'It is the duty of government,' says a well known writer, 'to interfere to regulate every business or pursuit that might otherwise become publicly injurious. On this principle it interferes to prevent the circulation of spurious coin.' Counterfeit coin is more readily detected than a fictitious paper currency, yet no sane man would advocate the repeal of the laws which prohibit it. Why, then, permit the unlimited manufacture of paper money of an unreliable character?

In the consideration of this subject we should divest ourselves of all selfish views of private profit and advantage. We should look only to the public good, to stability in trade and commerce, and to the general interests of the people at large as distinguished from those of a few individuals. It is clearly then the province of government to establish and to regulate the paper money of the nation, so that it shall possess the following attributes:

I. To be uniform in value throughout all portions of the country.

II. To be perfectly reliable at all times as a medium for the payment of debts.

III. To be issued in limited amounts, and under the control of the Government only.

IV. To be convertible, at the pleasure of the holder, into gold or silver.

It must be conceded that these requisites do not belong, and never can belong, to paper issued by joint stock banks, which are governed with a view to the largest profit, and which are but little known beyond their own immediate localities.

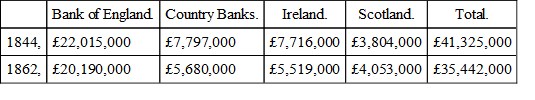

Recent history assures us that abuses have been practised in reference to the bank circulation of the country, which have led to violent revulsions and severe loss. England experienced the same results between the years 1790 and 1840, and to such an extent that in the year 1844 her statesmen devised a system whereby no further expansion of paper money should occur. The amount then existing was assumed to be a minimum of the amount required for commercial transactions, and it was ordered that all bank issues beyond that sum shall be represented by a deposit of gold.

If the Bank of England had been governed by considerations of public welfare, and not by those of private interest, it would not have reduced the rate of interest to 2-1/2 per cent. in 1844-'5, thus producing violent speculation, and leading to the revulsion of 1849. Nor would the bank have established low rates of interest only in the year 1857, thus leading this powerful institution to the verge of bankruptcy, and to the clemency of the British Cabinet in November of that year.

England has checked the paper circulation of the country, but has not withdrawn from the bank the power to promote speculation by extravagant loans at a low rate of discount.

The Governments of France and England have both assumed control of the paper currency of their respective countries. This is sound policy, and it is one of the prerogatives that must be exercised, in its full force, by the Government of the United States and by all other governments, if stability, permanency, consistency are to be observed or maintained for the people. This is obviously necessary in a time of peace and prosperity; it is perhaps more so in a time of rebellion or war, like the present. Circumstances may arise where it will be the course of wisdom and safety to suspend specie payment; and, in some extreme exigencies, to forbid the export of specie.

This position was well explained by Mr. J.W. Gilbart, manager of the London and Westminster Bank, who, in his testimony before Sir Robert Peel, in 1843, said, 'If I were prime minister, I would immediately, on the commencement of war, issue an order in council for the bank to stop payment. I stated also that I spoke as a politician, not as a banker. * * * I came to the conclusion that, under the circumstances of the war of 1797, a suspension of cash payments was not a matter of choice, but of necessity.' (Vide 'History of the Bank of England,' New York edition, p. 130.)

We come now to consider what is necessary, in order to restore the currency of the United States to a specie footing. This restoration is demanded alike by motives of justice and sound policy. No contracts can be well entered into, unless the currency of the country is upon a substantial and permanent footing of redemption. It is a matter which concerns every individual in the community; it is especially so to the General Government in view of its extraordinary expenditures: and no commercial prosperity can be maintained without it.

A restoration of public and private credit can be accomplished only by an observance of those sound principles of finance that have been announced by the wise men of our own and other countries. Mr. Alexander Hamilton, Mr. Gallatin, Mr. Jefferson, Mr. Madison, each in his turn advocated a national institution, by which the currency of the country could be placed upon a reliable and permanent footing. Such an institution should control the currency and receive surplus capital on deposit; but need not interfere with the legitimate operations of the State banks as borrowers and lenders of money, nor encourage in the slightest degree, through loans, any speculative movements among the people.

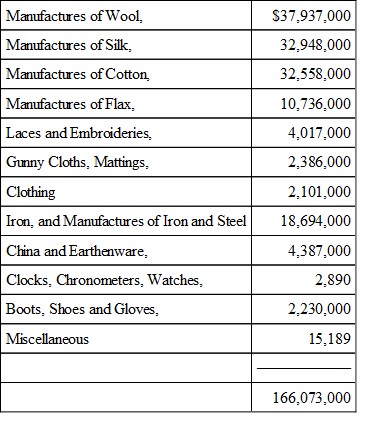

In the next place our people must resort to and maintain more economy in their individual expenditure, and thus preserve a balance of foreign trade in our own favor. It is shown that, during the fiscal year ending 30 June, 1860, there were imported into the United States goods, wholly manufactured, of the value of … $166,073,000, partially manufactured, 62,720,000.

We can dispense with two thirds of such articles during our present national reverses, and rely upon our own domestic labor for similar products, viz.:

besides other articles exceeding one hundred millions in value.

Rather than send abroad thirty or forty millions in gold annually, as we have done of late years, let us dispense with foreign woollen goods, silk and cotton goods, laces, &c., and encourage our own mills, at least until the war and its debt are over.

Mr. Madison said much in a few words, when he said:

'The theory of 'let us alone' supposes that all nations concur in a perfect freedom of commercial intercourse. Were this the case, they would, in a commercial view, be but one nation, as much as the several districts composing a particular nation; and the theory would be as applicable to the former as the latter. But this golden age of free trade has not yet arrived, nor is there a single nation that has set the example. No nation can, indeed, safely do so, until a reciprocity, at least, be insured to it. * * A nation, leaving its foreign trade, in all cases, to regulate itself, might soon find it regulated by other nations into subserviency to a foreign interest.'

There is much good sense, too, in the views promulgated by another president, who said, in relation to our independence of other nations:

'The tariff bill before us, embraces the design of fostering, protecting, and preserving within ourselves the means of national defence and independence, particularly in a state of war. * * * The experience of the late war (1812) taught us a lesson, and one never to be forgotten. If our liberty and republican form of government, procured for us by our Revolutionary fathers, are worth the blood and treasure at which they were obtained, it surely is our duty to protect and defend them. * * * What is the real situation of the agriculturist? Where has the American farmer a market for his surplus product? Except for cotton, he has neither a foreign nor home market. Does not this clearly prove, when there is no market either at home or abroad, that there is too much labor employed in agriculture, and that the channels of labor should be multiplied? Common sense points out the remedy. Draw from agriculture the superabundant labor; employ it in mechanism and manufactures; thereby creating a home-market for your bread-stuffs, and distributing labor to the most profitable account and benefits to the country. Take from agriculture in the United States six hundred thousand men, women and children, and you will at once give a home-market for more bread-stuffs than all Europe now furnishes us. In short, sir, we have been too long subject to the policy of British merchants. It is time that we should become a little more Americanized; and, instead of feeding the paupers and laborers of England, feed our own; or else, in a short time, by continuing our present policy, we shall be rendered paupers ourselves.'

Mr. Bigelow, in his late and highly valuable work on the tariff, says truly (p. 103):

'Can any one question that our home production far outweighs in importance all other material interests of the nation? * * * It is the nation of great internal resources, of vigorous productive power and self-dependent strength, which is always best prepared and most able, not only to defend itself, but to lend others a helping hand.'

If our people would maintain their own national integrity, their own individual independence, and their true status in the great family of nations of the earth, they will [at least until the present rebellion is crushed, and until the public debt thereby created shall be extinguished] pursue a strict course of public and private economy. Let us encourage and support our own manufactures, and thereby contribute to the subsistence and wealth of our own laborers instead of contributing millions annually to the pauper labor of European nations; especially of those nations that have failed to give us countenance in the present struggle and that have, on the contrary, given both direct and indirect aid to the rebels of the South.

The United States have within themselves, in great abundance, contributed by a bountiful Providence, the leading products of the earth. In metals and in agricultural products, we exceed any and all other countries of the earth. If we encourage the labor of our own people in the development of the great resources of the country, we shall not only preserve our own commercial independence, but we shall soon be, as we ought to be in view of such advantages, the creditor nation of the world, and compel other countries to resort to us for the raw materials for their own manufacturing districts.

With the aid of the vast iron and coal mines of our own country, we can construct and keep in force an adequate navy for peace or for war. Our skilled industry can produce firearms equal to any in the world. The vast agricultural resources of the West yield abundance for ourselves and a large surplus for other countries. The breadstuffs of the West and Northwest; the tobacco of the Middle States, and the cotton of the South are in demand, throughout nearly all Europe. Let us then be independent ourselves of foreign manufacturers, and endeavor to place the rest of the world under obligations to our own country for the necessaries of life. This will do more to preserve peace than all the arguments of cabinets or the combined navies and armies of the world.

Lord Palmerston and Lord John Russell said,7 in parliament, in 1842, five years before the famine in Ireland: 'We are not, we cannot be, independent of foreign nations, any more than they can of us: * * * two millions of our people have been dependent on foreign countries for their daily food. At least five millions of our people are dependent on the supplies of cotton from America, of foreign wool or foreign silk. * * * The true independence of a great commercial nation is to be found, not in raising all the produce it requires within its own bound, but in attaining such a preëminence in commerce that the time can never arise when other nations will not be compelled, for their own sales, to minister to its wants.'