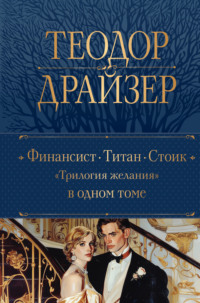

Полная версия

The Financier / Финансист. Книга для чтения на английском языке

So came Lillian Semple, who was nothing more to him than the shadow of an ideal. Yet she cleared up certain of his ideas in regard to women. She was not physically as vigorous or brutal as those other women whom he had encountered in the lupanars[31], thus far – raw, unashamed contraveners of accepted theories and notions – and for that very reason he liked her. And his thoughts continued to dwell on her, notwithstanding the hectic days which now passed like flashes of light in his new business venture. For this stock exchange world in which he now found himself, primitive as it would seem to-day, was most fascinating to Cowperwood. The room that he went to in Third Street, at Dock, where the brokers or their agents and clerks gathered one hundred and fifty strong, was nothing to speak of artistically – a square chamber sixty by sixty, reaching from the second floor to the roof of a four-story building; but it was striking to him. The windows were high and narrow; a large-faced clock faced the west entrance of the room where you came in from the stairs; a collection of telegraph instruments, with their accompanying desks and chairs, occupied the northeast corner. On the floor, in the early days of the exchange, were rows of chairs where the brokers sat while various lots of stocks were offered to them. Later in the history of the exchange the chairs were removed and at different points posts or floor-signs indicating where certain stocks were traded in were introduced. Around these the men who were interested gathered to do their trading. From a hall on the third floor a door gave entrance to a visitor’s gallery, small and poorly furnished; and on the west wall a large blackboard carried current quotations in stocks as telegraphed from New York and Boston. A wicket-like fence in the center of the room surrounded the desk and chair of the official recorder; and a very small gallery opening from the third floor on the west gave place for the secretary of the board, when he had any special announcement to make. There was a room off the southwest corner, where reports and annual compendiums of chairs were removed and at different signs indicating where certain stocks of various kinds were kept and were available for the use of members.

Young Cowperwood would not have been admitted at all, as either a broker or broker’s agent or assistant, except that Tighe, feeling that he needed him and believing that he would be very useful, bought him a seat on ’change – charging the two thousand dollars it cost as a debt and then ostensibly taking him into partnership. It was against the rules of the exchange to sham a partnership in this way in order to put a man on the floor, but brokers did it. These men who were known to be minor partners and floor assistants were derisively called “eighth chasers” and “two-dollar brokers,” because they were always seeking small orders and were willing to buy or sell for anybody on their commission, accounting, of course, to their firms for their work. Cowperwood, regardless of his intrinsic merits, was originally counted one of their number, and he was put under the direction of Mr. Arthur Rivers, the regular floor man of Tighe & Company.

Rivers was an exceedingly forceful man of thirty-five, well-dressed, well-formed, with a hard, smooth, evenly chiseled face, which was ornamented by a short, black mustache and fine, black, clearly penciled eyebrows. His hair came to an odd point at the middle of his forehead, where he divided it, and his chin was faintly and attractively cleft. He had a soft voice, a quiet, conservative manner, and both in and out of this brokerage and trading world was controlled by good form. Cowperwood wondered at first why Rivers should work for Tighe – he appeared almost as able – but afterward learned that he was in the company. Tighe was the organizer and general hand-shaker, Rivers the floor and outside man.

It was useless, as Frank soon found, to try to figure out exactly why stocks rose and fell. Some general reasons there were, of course, as he was told by Tighe, but they could not always be depended on.

“Sure, anything can make or break a market” – Tighe explained in his delicate brogue – “from the failure of a bank to the rumor that your second cousin’s grandmother has a cold. It’s a most unusual world, Cowperwood. No man can explain it. I’ve seen breaks in stocks that you could never explain at all – no one could. It wouldn’t be possible to find out why they broke. I’ve seen rises the same way. My God, the rumors of the stock exchange! They beat the devil. If they’re going down in ordinary times someone is unloading, or they’re rigging the market.[32] If they’re going up – God knows times must be good or somebody must be buying – that’s sure. Beyond that – well, ask Rivers to show you the ropes. Don’t you ever lose for me, though. That’s the cardinal sin[33] in this office.” He grinned maliciously, even if kindly, at that.

Cowperwood understood – none better. This subtle world appealed to him. It answered to his temperament.

There were rumors, rumors, rumors – of great railway and street-car undertakings, land developments, government revision of the tariff, war between France and Turkey, famine in Russia or Ireland, and so on. The first Atlantic cable had not been laid as yet, and news of any kind from abroad was slow and meager. Still there were great financial figures in the held, men who, like Cyrus Field, or William H. Vanderbilt, or F. X. Drexel[34], were doing marvelous things, and their activities and the rumors concerning them counted for much.

Frank soon picked up all of the technicalities[35] of the situation. A “bull,” he learned, was one who bought in anticipation of a higher price to come; and if he was “loaded up” with a “line” of stocks he was said to be “long.” He sold to “realize” his profit, or if his margins were exhausted he was “wiped out.” A “bear” was one who sold stocks which most frequently he did not have, in anticipation of a lower price, at which he could buy and satisfy his previous sales. He was “short” when he had sold what he did not own, and he “covered” when he bought to satisfy his sales and to realize his profits or to protect himself against further loss in case prices advanced instead of declining. He was in a “corner” when he found that he could not buy in order to make good the stock he had borrowed for delivery and the return of which had been demanded. He was then obliged to settle practically at a price fixed by those to whom he and other “shorts” had sold.

He smiled at first at the air of great secrecy and wisdom on the part of the younger men. They were so heartily and foolishly suspicious. The older men, as a rule, were inscrutable. They pretended indifference, uncertainty. They were like certain fish after a certain kind of bait, however. Snap! and the opportunity was gone. Somebody else had picked up what you wanted. All had their little note-books. All had their peculiar squint of eye or position or motion which meant “Done! Itake you!” Sometimes they seemed scarcely to confirm their sales or purchases – they knew each other so well – but they did. If the market was for any reason active, the brokers and their agents were apt to be more numerous than if it were dull and the trading indifferent. A gong sounded the call to trading at ten o’clock, and if there was a noticeable rise or decline in a stock or a group of stocks, you were apt to witness quite a spirited scene. Fifty to a hundred men would shout, gesticulate, shove here and there[36] in an apparently aimless manner; endeavoring to take advantage of the stock offered or called for.

“Five-eighths for five hundred P. and W.,” someone would call – Rivers or Cowperwood, or any other broker.

“Five hundred at three-fourths,” would come the reply from someone else, who either had an order to sell the stock at that price or who was willing to sell it short, hoping to pick up enough of the stock at a lower figure later to fill his order and make a little something besides. If the supply of stock at that figure was large Rivers would probably continue to bid five-eighths. If, on the other hand, he noticed an increasing demand, he would probably pay three-fourths for it. If the professional traders believed Rivers had a large buying order, they would probably try to buy the stock before he could at three-fourths, believing they could sell it out to him at a slightly higher price. The professional traders were, of course, keen students of psychology; and their success depended on their ability to guess whether or not a broker representing a big manipulator, like Tighe, had an order large enough to affect the market sufficiently to give them an opportunity to “get in and out,”[37] as they termed it, at a profit before he had completed the execution of his order. They were like hawks watching for an opportunity to snatch their prey from under the very claws of their opponents.

Four, five, ten, fifteen, twenty, thirty, forty, fifty, and sometimes the whole company would attempt to take advantage of the given rise of a given stock by either selling or offering to buy, in which case the activity and the noise would become deafening. Given groups might be trading in different things; but the large majority of them would abandon what they were doing in order to take advantage of a speciality. The eagerness of certain young brokers or clerks to discover all that was going on, and to take advantage of any given rise or fall, made for quick physical action, darting to and fro, the excited elevation of explanatory fingers. Distorted faces were shoved over shoulders or under arms. The most ridiculous grimaces were purposely or unconsciously indulged in. At times there were situations in which some individual was fairly smothered with arms, faces, shoulders, crowded toward him when he manifested any intention of either buying or selling at a profitable rate. At first it seemed quite a wonderful thing to young Cowperwood – the very physical face of it – for he liked human presence and activity; but a little later the sense of the thing as a picture or a dramatic situation, of which he was a part faded, and he came down to a clearer sense of the intricacies of the problem before him. Buying and selling stocks, as he soon learned, was an art, a subtlety, almost a psychic emotion. Suspicion, intuition, feeling – these were the things to be “long” on.

Yet in time he also asked himself, who was it who made the real money – the stock-brokers? Not at all. Some of them were making money, but they were, as he quickly saw, like a lot of gulls or stormy petrels, hanging on the lee of the wind[38], hungry and anxious to snap up any unwary fish. Back of them were other men, men with shrewd ideas, subtle resources. Men of immense means whose enterprise and holdings these stocks represented, the men who schemed out and built the railroads, opened the mines, organized trading enterprises, and built up immense manufactories. They might use brokers or other agents to buy and sell on ’change; but this buying and selling must be, and always was, incidental to the actual fact – the mine, the railroad, the wheat crop, the flour mill, and so on. Anything less than straight-out sales to realize quickly on assets, or buying to hold as an investment, was gambling pure and simple, and these men were gamblers. He was nothing more than a gambler’s agent. It was not troubling him any just at this moment, but it was not at all a mystery now, what he was. As in the case of Waterman & Company, hesized up these men shrewdly, judging some to be weak, some foolish, some clever, some slow, but in the main all small-minded or deficient because they were agents, tools, or gamblers. A man, a real man, must never be an agent, a tool, or a gambler – acting for himself or for others – he must employ such. A real man – a financier – was never a tool. He used tools. He created. He led.

Clearly, very clearly, at nineteen, twenty, and twenty-one years of age, he saw all this, but he was not quite ready yet todo anything about it. He was certain, however, that his day would come.

Chapter VII

In the meantime, his interest in Mrs. Semple had been secretly and strangely growing. When he received an invitation to call at the Semple home, he accepted with a great deal of pleasure. Their house was located not so very far from his own, on North Front Street, in the neighborhood of what is now known as No. 956. It had, in summer, quite a wealth of green leaves and vines. The little side porch which ornamented its south wall commanded a charming view of the river, and all the windows and doors were topped with lunettes of small-paned glass. The interior of the house was not as pleasing ashe would have had it. Artistic impressiveness, as to the furniture at least, was wanting, although it was new and good. The pictures were – well, simply pictures. There were no books to speak of – the Bible, a few current novels, some of the more significant histories, and a collection of antiquated odds and ends in the shape of books[39] inherited from relatives. The china was good – of a delicate pattern. The carpets and wall-paper were too high in key[40]. So it went. Still, the personality of Lillian Semple was worth something, for she was really pleasing to look upon, making a picture wherever she stood or sat.

There were no children – a dispensation of sex conditions which had nothing to do with her, for she longed to have them. She was without any notable experience in social life, except such as had come to the Wiggin family, of which she was a member – relatives and a few neighborhood friends visiting. Lillian Wiggin, that was her maiden name – had two brothers and one sister, all living in Philadelphia and all married at this time. They thought she had done very well in her marriage.

It could not be said that she had wildly loved Mr. Semple at any time. Although she had cheerfully married him, he was not the kind of man who could arouse a notable passion in any woman. He was practical, methodic, orderly. His shoe store was a good one – well-stocked with styles reflecting the current tastes and a model of cleanliness and what one might term pleasing brightness. He loved to talk, when he talked at all, of shoe manufacturing, the development of lasts and styles. The ready-made shoe – machine-made to a certain extent – was just coming into its own slowly, and outside of these, supplies of which he kept, he employed bench-making shoemakers[41], satisfying his customers with personal measurements and making the shoes to order.

Mrs. Semple read a little – not much. She had a habit of sitting and apparently brooding reflectively at times, but it was not based on any deep thought. She had that curious beauty of body, though, that made her somewhat like a figure on an antique vase, or out of a Greek chorus. It was in this light, unquestionably, that Cowperwood saw her, for from the beginning he could not keep his eyes off her. In a way, she was aware of this but she did not attach any significance to it. Thoroughly conventional, satisfied now that her life was bound permanently with that of her husband, she had settled down to a staid and quiet existence.

At first, when Frank called, she did not have much to say. She was gracious, but the burden of conversation fell on her husband. Cowperwood watched the varying expression of her face from time to time, and if she had been at all psychic she must have felt something. Fortunately she was not. Semple talked to him pleasantly, because in the first place Frank was becoming financially significant, was suave and ingratiating, and in the next place he was anxious to get richer and somehow Frank represented progress to him in that line. One spring evening they sat on the porch and talked – nothing very important – slavery, street-cars, the panic – it was on then, that of 1857[42] – the development of the West. Mr. Semple wanted to know all about the stock exchange. In return Frank asked about the shoe business, though he really did not care. All the while, inoffensively, he watched Mrs. Semple. Her manner, hethought, was soothing, attractive, delightful. She served tea and cake for them. They went inside after a time to avoid the mosquitoes. She played the piano. At ten o’clock he left.

Thereafter, for a year or so, Cowperwood bought his shoes of Mr. Semple. Occasionally also he stopped in the Chestnut Streetstore to exchange the time of the day[43]. Semple asked his opinion as to the advisability of buying some shares in the Fifth and Sixth Street line, which, having secured a franchise, was creating great excitement. Cowperwood gave him his best judgment. It was sure to be profitable. He himself had purchased one hundred shares at five dollars a share, and urged Semple to do so. But he was not interested in him personally. He liked Mrs. Semple, though he did not see her very often.

About a year later, Mr. Semple died. It was an untimely death, one of those fortuitous and in a way insignificant episodes which are, nevertheless, dramatic in a dull way to those most concerned. He was seized with a cold in the chest late in the fall – one of those seizures ordinarily attributed to wet feet or to going out on a damp day without an overcoat – and had insisted on going to business when Mrs. Semple urged him to stay at home and recuperate. He was in his way a very determined person, not obstreperously so, but quietly and under the surface. Business was a great urge. He saw himself soon to be worth about fifty thousand dollars. Then this cold – nine more days of pneumonia – and he was dead. The shoe store was closed for a few days; the house was full of sympathetic friends and church people. There was a funeral, with burial service in the Callowhill Presbyterian Church, to which they belonged, and then he was buried. Mrs. Semple cried bitterly. The shock of death affected her greatly and left her for a time in a depressed state. A brother of hers, David Wiggin, undertook for the time being to run the shoe business for her. There was no will, but in the final adjustment, which included the sale of the shoe business, there being no desire on anybody’s part to contest her right to all the property, she received over eighteen thousand dollars. She continued to reside in the Front Street house, and was considered a charming and interesting widow.

Throughout this procedure young Cowperwood, only twenty years of age, was quietly manifest[44]. He called during the illness. He attended the funeral. He helped her brother, David Wiggin, dispose of the shoe business. He called once or twice after the funeral, then stayed away for a considerable time. In five months he reappeared, and thereafter he was a caller at stated intervals – periods of a week or ten days.

Again, it would be hard to say what he saw in Semple. Her prettiness, wax-like in its quality, fascinated him; her indifference aroused perhaps his combative soul. He could not have explained why, but he wanted her in an urgent, passionate way. He could not think of her reasonably, and he did not talk of her much to any one. His family knew that he went to see her, but there had grown up in the Cowperwood family a deep respect for the mental force of Frank. He was genial, cheerful, gay at most times, without being talkative, and he was decidedly successful. Everybody knew he was making money now. His salary was fifty dollars a week, and he was certain soon to get more. Some lots of his in West Philadelphia, bought three years before, had increased notably in value. His street-car holdings, augmented by still additional lots of fifty and one hundred and one hundred and fifty shares in new lines incorporated, were slowly rising, in spite of hard times, from the initiative five dollars in each case to ten, fifteen, and twenty-five dollars a share – all destined to go to par. He was liked in the financial district and he was sure that he had a successful future. Because of his analysis of the brokerage situation he had come to the conclusion that he did not want to be a stock gambler. Instead, he was considering the matter of engaging in bill-brokering, a business which he had observed to be very profitable and which involved no risk as long as one had capital. Through his work and his father’s connections he had met many people – merchants, bankers, traders. He could get their business, or a part of it, he knew. People in Drexel & Co. and Clark & Co. were friendly to him. Jay Cooke, a rising banking personality, was a personal friend of his.

Meanwhile he called on Mrs. Semple, and the more he called the better he liked her. There was no exchange of brilliant ideas between them; but he had a way of being comforting and social when he wished. He advised her about her business affairs in so intelligent a way that even her relatives approved of it. She came to like him, because he was so considerate, quiet, reassuring, and so ready to explain over and over until everything was quite plain to her. She could see that he was looking on her affairs quite as if they were his own, trying to make them safe and secure.

“You’re so very kind, Frank,” she said to him, one night. “I’m awfully grateful. I don’t know what I would have done if it hadn’t been for you.”

She looked at his handsome face, which was turned to hers, with childlike simplicity.

“Not at all. Not at all. I want to do it. I wouldn’t have been happy if I couldn’t.”

His eyes had a peculiar, subtle ray in them – not a gleam. She felt warm toward him, sympathetic, quite satisfied that she could lean on him.

“Well, I am very grateful just the same. You’ve been so good. Come out Sunday again, if you want to, or any evening. I’ll be home.”

It was while he was calling on her in this way that his Uncle Seneca died in Cuba and left him fifteen thousand dollars. This money made him worth nearly twenty-five thousand dollars in his own right, and he knew exactly what to do with it. A panic had come since Mr. Semple had died, which had illustrated to him very clearly what an uncertain thing the brokerage business was. There was really a severe business depression. Money was so scarce that it could fairly be said not to exist at all. Capital, frightened by uncertain trade and money conditions, everywhere, retired to its hiding-places in banks, vaults, teakettles, and stockings. The country seemed to be going to the dogs.[45] War with the South or secession was vaguely looming up in the distance. The temper of the whole nation was nervous. People dumped their holdings on the market in order to get money. Tighe discharged three of his clerks. He cut down his expenses in every possible way, and used up all his private savings to protect his private holdings. He mortgaged his house, his land holdings – everything; and in many instances young Cowperwood was his intermediary, carrying blocks of shares to different banks to get what he could on them.

“See if your father’s bank won’t loan me fifteen thousand on these,” he said to Frank, one day, producing a bundle of Philadelphia & Wilmington shares. Frank had heard his father speak of them in times past as excellent.

“They ought to be good,” the elder Cowperwood said, dubiously, when shown the package of securities. “At any other time they would be. But money is so tight. We find it awfully hard these days to meet our own obligations. I’ll talk to Mr. Kugel.” Mr. Kugel was the president.

There was a long conversation – a long wait. His father came back to say it was doubtful whether they could make the loan. Eight per cent., then being secured for money, was a small rate of interest, considering its need. For ten per cent. Mr. Kugel might make a call-loan. Frank went back to his employer, whose commercial choler rose at the report.

“For Heaven’s sake, is there no money at all in the town?” he demanded, contentiously. “Why, the interest they want is ruinous! I can’t stand that. Well, take ’em back and bring me the money. Good God, this’ll never do at all, at all!”

Frank went back. “He’ll pay ten per cent.,” he said, quietly. Tighe was credited with a deposit of fifteen thousand dollars, with privilege to draw against it at once.[46] He made out a check for the total fifteen thousand at once to the Girard National Bank to cover a shrinkage there. So it went.

During all these days young Cowperwood was following these financial complications with interest. He was not disturbed by the cause of slavery, or the talk of secession, or the general progress or decline of the country, except in so far asit affected his immediate interests. He longed to become astable financier; but, now that he saw the inside of the brokerage business, he was not so sure that he wanted to stay in it. Gambling in stocks, according to conditions produced by this panic, seemed very hazardous. A number of brokers failed. He saw them rush in to Tighe with anguished faces and ask that certain trades be canceled. Their very homes were in danger, they said. They would be wiped out, their wives and children put out on the street.