Полная версия

The only reason why you don`t own Bitcoin is that you don`t know enough about it…

Saylor explains that half of the world has no hope of accumulating property while the other half takes risks with their property. Bitcoin is a technology that gives everyone the right to personal sovereignty and their own property.

Trust is more expensive than gold

The complete abandonment of the gold standard occurred between 1976 and 1980, when all countries, including the United States, gradually abandoned the gold standard, allowing their currencies to float freely in international currency markets.

If we had still used the gold standard, the economy and financial system could have had some differences. For example, a limited supply of gold could limit the expansion of money supply and economic growth.

A more predictable and stable monetary system based on a limited supply of gold could provide more confidence and trust in the system. However, the limitations of the gold standard would create problems in situations requiring rapid mobilization of resources or response to economic crises.

These concerns led to the final abandonment of the gold standard and the transition to a system of fiat currencies, where the value of money is determined by supply and demand in the market. The gold standard had its pros and cons. One of the pluses was the restriction of the state in the flexible management of the country and the prohibition of the possibility of getting money from nowhere.

Occasionally, there were situations where a shortage of gold or an excess of gold led to economic problems. For instance, if the country needed a major construction project and the treasury was short of funds, with the gold standard, the government could not simply print money. Instead, it had to suspend construction until the required amount was accumulated. Also, if the government started a war and the citizens were against it, they could cut back on consumption, and the money would stay with the people. It caused difficulties for the insolent government in financing the war effort.

The gold standard also limited the ability of governments to control the economy and manipulate money. It could also prevent the destructive influence of politicians and government. At the same time, the gold standard gave the population greater financial independence and incentivized the preservation of valuable ideas and innovations without the risk of government impairment. However, history has shown that the gold standard had limitations and led to a shift to more flexible monetary systems.

Today, we are seeing the development of new technologies, such as cryptocurrencies, that offer alternative approaches to monetary policy and financial stability. These innovations open up new economic and societal opportunities but also come with certain risks and challenges.

In this way, the history of the gold standard reminds us of the complex interrelationships between government intervention and economic development. The world is constantly changing, and we are learning from the past as we strive to create more flexible and sustainable systems that meet the needs of today’s economy. BITCOIN itself is a tremendous combination of sections of academic sciences and disciplines such as economics and finance, programming, and financial law. Therefore, even with a 2, 3, or 4 educations, a person will not understand the essence of Bitcoin at once.

One of the most important features of Bitcoin is that it is a currency that has not been known in the world before. It is an entirely new part of the economy, and currently, no single focused education process delivered professionally can explain what Bitcoin is.

Acceptance of BITCOIN

Psychology identifies 3 to 7 stages of accepting the inevitable. Here are the three main ones:

Denial. People in this stage may refuse to accept information about the inevitable event and stubbornly deny its reality. They may look for excuses or seek to find reasons why the event should not happen.

Anger. People in this stage may display anger and irritation toward those associated with the inevitable event. They may be aggressive and express anger and resentment.

Humility. People who have reached this stage accept the inevitable event and may begin to find ways to come to terms with it. They may start to find ways to adapt to the new situation or look for new opportunities.

Given the current trend of acceptance, the price of BTC will grow strongly over the next ten years and then follow a more linear trend. Bitcoin has yet to reach even half of its adoption potential, which means that the highest growth is yet to come. Bitcoin will perform outstandingly in the coming decades when only 4% of the world’s population will use it, and then that number will only increase. In the long term, BTC is expected to grow significantly, and despite short-term declines, we should pay attention to the overall development trend.

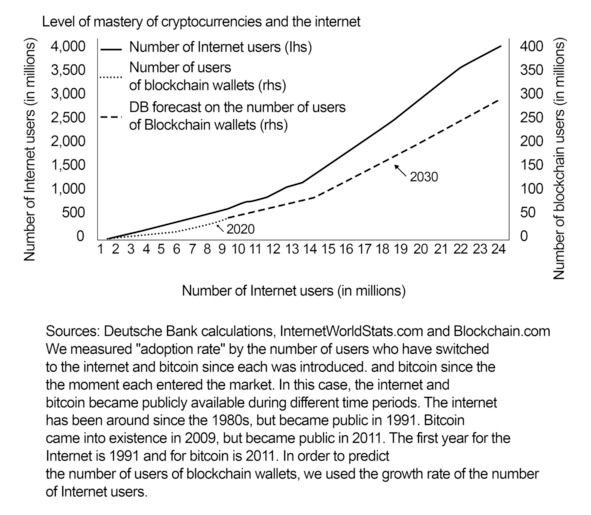

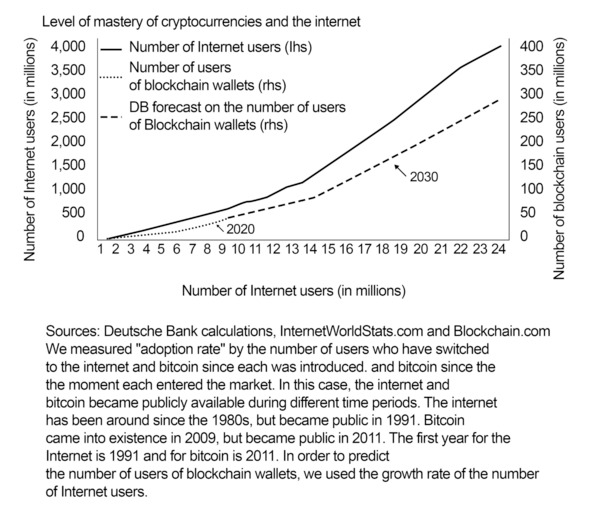

Let’s consider how users came to the World Wide Web and blockchain.

Figure 7 shows the curves of Internet users and active cryptocurrency wallets over the 24 years of the World Wide Web’s existence. The dotted line indicates the expected growth rate of the number of blockchain wallets based on the Internet adoption dynamics in the past.

Fig.7 The level of take-up of cryptocurrencies and the Internet

As we can see, both technologies had a slow start in the first few years. In eight years, the number of Internet users worldwide grew to 500 million, while only 50 million people started using blockchain in the same period of time. It took the Internet a quarter of a century to reach more than 4 billion people. The blockchain user base is projected to grow to 350 million people in the same timeframe (Figure 7).

The study only covers the period of time when the Web has already become a user-driven phenomenon. The network began to be created in the United States in the sixties, but at that time, it was used only by government organizations. It wasn’t until the nineties that the Internet began to gain noticeable popularity among ordinary people, both in America and the rest of the world.

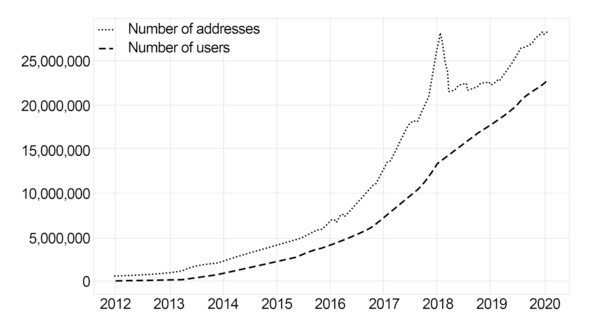

The approximate number of Bitcoin wallet owners with a balance of more than zero exceeded 23 million people as of 2020. As of 2023, according to the latest tweet published by crypto analyst Ali, the current number of BTC holders exceeded the entire population of Spain (47.5 million), reaching 48.5 million people. An interesting comparison between the number of addresses and Bitcoin users is shown in the following graph.

Fig.8 Comparison of the number of BTC addresses and users

The bottom line of the graph shows that the number of Bitcoin users grew linearly from 2018 to 2020. Therefore, we did not have a sudden upsurge, as people entered the market gradually. Nevertheless, despite the lack of frantic price growth, the number of Bitcoin users has been growing steadily, and more and more people are starting to use the first cryptocurrency (Fig.8).

If we remember market cycles and look at the same graph and the bottom line from 2016 to 2017, we see a parabola when the influx of new people into the market was many times greater. It is quite logical, given the sharp rise in prices at the time, but now the excitement has subsided, and the industry lives off those who have made a conscious choice to use cryptocurrencies.

What BITCOIN is like

Bitcoin is like a bank, only better because you can put money into Bitcoin and earn income from the growth of a currency that relies on inflation as long as you buy it at the lower end of cost. Think of the interest rates banks offer. Usually, it is 2% per annum in dollars and euros. Thus, over three years, you will get 6% at best. In turn, BTC has risen in price by 150% over the past three years, and this does not include the moments when its rate increased by 400%.

Bitcoin is a cross-border transfer system. It can be used to make payments and transfers for goods and services in the same way as using a bank card.

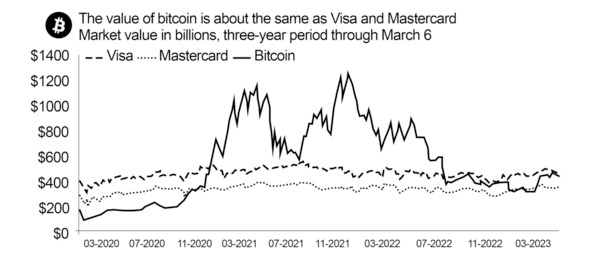

Bitcoin is a company’s share because when investing in BTC, it is as if you buy shares in the form of tokens and, owning them, receive dividends in the form of growth in the company’s capitalization. Bitcoin’s market capitalization now rivals that of Visa (NYSE: V) and Mastercard (NYSE: MA), which have had millions of users and name recognition for decades (Figure 9).

Fig.9 Market value of bitcoin

Bitcoin is decentralized, meaning it has no CEO, board of directors, and marketing budget. Yet its total value is roughly the same as the two largest credit card companies. Securities, such as stocks or bonds, give investors rights to a share of ownership, profits, or the right to receive interest payments. They usually have a legal status and are governed by relevant laws and regulations. Bitcoin has no legal status and is not regulated by central or state authorities. Bitcoin is not a security because it is not a financial instrument that entitles you to a share of ownership or profits from any company or asset. Unlike stocks, bonds, or other securities, bitcoin is a cryptocurrency, a digital asset operated on blockchain technology*.

Bitcoin is a business — you can buy equipment, rent it out to a network, and get paid for it, or buy part of a mining company as an investor. You can even directly buy hash rate in the form of tokens, open an exchange platform, or put your Bitcoin ATM. Everything is as it should be — business purchases goods cheaper and sells them more expensive.

The definition that bitcoin is MLM (multi-level marketing) is very superficial. There is no business plan or tiers, but there are product consumers who recommend the product to others and attract new members to the network. The more participants or users, the more valuable the currency is.

Bitcoin is the new perfect money. You can exchange them for any goods you have in the world. Although, it is not yet as easy to do as exchanging US dollars or euros. You have to search for who accepts Bitcoin, but it is possible. And BTC is, by all definitions, money, or maybe even something more. Bitcoin can be considered the digital equivalent of cash without the physical embodiment. It serves as a medium of exchange, a store of value, and an investment asset, but it does not have the attributes of a security. Bitcoin has no relation to any companies or project’s financial health or profits. Yes, bitcoin is not very suitable for transferring small amounts of money, and yes, while you will pay for the product, its price may fall or rise. But we will come back to this issue later.

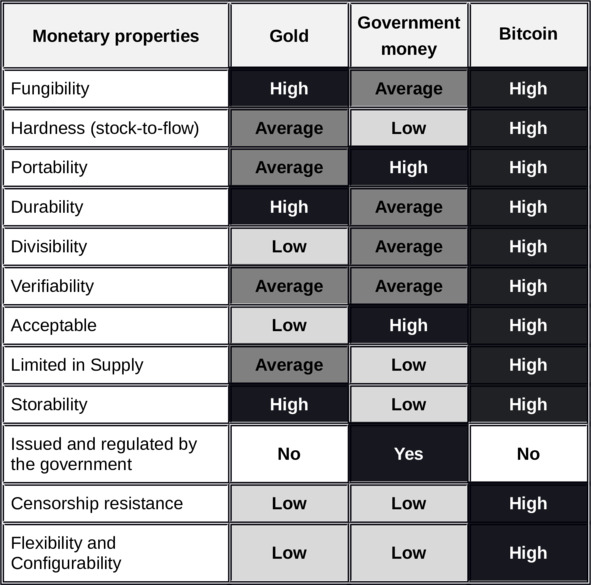

Bitcoin is gold, but it has one key difference: gold, like Bitcoin, resists inflation on its own, but it is harder to store, move, and sell.

Besides, one day, gold will be mined so much that there will be no point in new mining, and the price will stop rising. And if there is a crisis, all production companies will start reducing their purchases to save themselves. In the end, gold, like the states, will lose, and its price will fall.

As we can see, gold is significantly inferior to bitcoin, and in addition, unlike BTC, it does not participate in the role of raw materials for the company like gold. In contrast, it has a different role. It is more of an arbitrage and not a commodity role. But as great as Bitcoin is, it still doesn’t come close to the market value of gold and silver, the other two decentralized assets.

The total global value of gold is just over $12 trillion, and silver is worth about $1 trillion. I believe this is favorable for bitcoin, which currently has a market capitalization of about $433 billion. For a digital asset to have the same value as silver, each bitcoin must be valued at $60k, which it has reached before and will likely reach again.

For BTC to become as valuable as gold, it would have to trade for a staggering 630 thousand dollars, which is not the best option if we want to have time to stockpile this valuable resource (Fig.10).

Fig 10 Advantages of Bitcoin compared to Gold and government money

Bitcoin is the most secure database, and for many years since its inception in 2009, no one has been able to trick, hack, or alter it in any way. Anything can be written into this database, up to 4 MB in size, and this information will be stored in the network’s memory until our planet ceases to exist.

Bitcoin is a commodity expressed at its best. According to the U.S. Commodity Futures Trading Commission (CFTC), bitcoin is the only crypto-asset officially considered a commodity. All other coins and tokens can be classified as securities. Now, think about why I am talking about Bitcoin and not its alternatives.

Bitcoin is a religion or sect that believes jealously in technology and the possibility of a decent life given to everyone. Bitcoin has its own symbol, similar to the cross for Christianity or the crescent moon for Islam. Its «B» symbol is known by literally every person on the planet who has accessed the Internet at least once. In such a religion, there is a specific «God of Bitcoin,» symbolizing the incomprehensible idea of a decentralized financial system.

There are also sacred texts containing information about blockchain and cryptocurrency. There are rituals associated with using or investing in Bitcoin to help believers feel connected to its ideas and community. There are holidays like Bitcoin’s birthday or the famous Bitcoin Pizza Day dedicated to the first purchase made with the coin. There is also a mythical creator – Satoshi Nakamoto, and other personalities who have made a particular contribution to the development of Bitcoin and have been honored, brought gifts, or invested in charity or development projects supporting Bitcoin. There is even merch – symbols, items, and clothing that help users identify with this religion. You don’t have to go far – you’re holding this book that is also part of the Bitcoin culture and religion.

Now for a more complex concept. Bitcoin is a cryptocurrency based on the Bitcoin Protocol, which uses a distributed network of nodes (nodes) to provide security and transaction support. If you don’t know what it is, don’t feel bad. The main thing to remember is that the BTC network is resilient to censorship and single points of failure. Plus, bitcoin uses cryptographic methods to ensure security.

Over the years, bitcoin has demonstrated the reliability and resilience of its system, and it has never been hacked in its 14 years of existence.

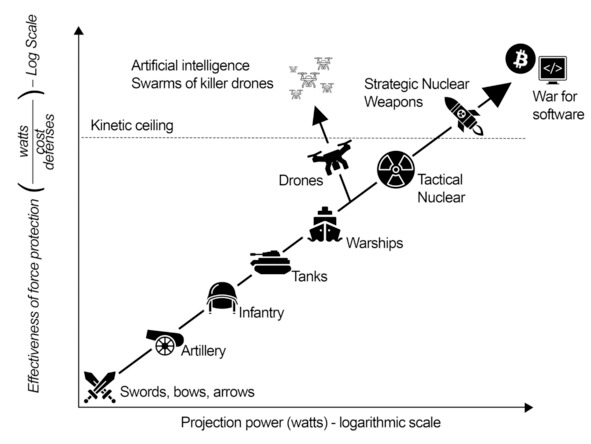

Bitcoin is a means of waging soft warfare. Soft warfare (non-linear or hybrid warfare) is a conflict strategy that uses unconventional methods and tactics rather than armed aggression to achieve its goals. Soft warfare includes information operations, economic pressure, diplomatic tactics, cyberattacks, and other unarmed measures. Soft warfare has become more common in the modern world, especially with the development of information technology and social media, which allow for the rapid spread of misinformation and manipulation of public opinion. The main objective of soft warfare is to achieve political, economic, and cultural advantages without overt use of armed force. It can include interfering in the internal affairs of other states, disinformation, and manipulation of public opinion, weakening foreign economies, supporting non-governmental organizations, terrorist groups, etc. If all of this can be done with fiat money and gold, it is possible with Bitcoin (Figure 11).

Fig.11 Bitcoin as a means of achieving political, economic, and cultural advantages without the overt use of armed force

Bitcoin is a public voting system. If verified wallets are assigned to each person at the state level, by transferring a minimal amount of money, a person can cast a vote in an election or referendum. This way, you can have the most honest, secure, and open system of open voting without spending millions of dollars on election preparation to get people’s opinions.

And lastly, bitcoin is a payment system for states and the largest companies in the world.

The list can go on indefinitely, saying that Bitcoin resembles a financial pyramid scheme, an anonymous darknet wallet, a way to launder money, or something else. And in a way, those who call BTC such words are right, but only partially. Over time, people will find dozens more meanings for Bitcoin and its properties, and each meaning will be correct for a particular people group. Therefore, no matter how one tries to compare everything in the world to Bitcoin, it will turn out that this is partly true for Bitcoin, but overall, it does not fall into any of the categories humans have invented.

The most accurate way to put it is that Bitcoin is a combination of all of the above, but certainly, in each case, its merits are most pronounced.

Bitcoin is an interdisciplinary technology, a unique combination of different technologies and fields of knowledge, which makes it an interesting research and practical topic for many professionals, academics, and just curious people like you and me.

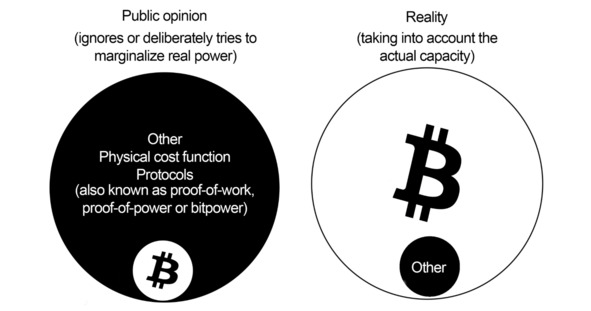

Fig.12 A visualization of the difference between public perception and the actual state of bitcoin

One more reason for BITCOIN’s value

You are probably still wondering why Bitcoin has become so recognizable and why no other cryptocurrency has or will reach its heights. I will now briefly answer this question for you.

The initial number of bitcoins that mankind can mine is 21 million coins.

The entire stock of BTC in humanity’s hands ends at the 21,000,000 mark. For example, Ethereum (the second most popular cryptocurrency) already exceeds 200 million and has no upper limit.

Currently, miners (people engaged in mining cryptocurrency) have already mined 19 million BTC, traded on exchanges, or waiting for their time in crypto wallets.

Of course, with each coin mined, the difficulty of mining increases, and it is predicted that the last BTC will not be mined until 2140. But there is one big BUT!

Tremendous parts of these coins have disappeared without a trace or are considered lost. According to statistics, the share of lost coins is about 20—30% of all existing bitcoins, i.e., about 4—6 million. Some are still stored on lost or failed flash drives or hard disks. It is 30% of users who violated the rules of Bitcoin storage and transfer and failed to save their seed phrases.

Thus, twice as much BTC has been lost in the past ten years as will be mined in the next 120 years!

What’s the point of all this? The simple answer is that Bitcoin’s value is rising not only because it has absorbed so many unique values but also because it is incredibly limited. And given that coins are lost, and their numbers dwindle, their value only increases over time.

Fortunately, if you don’t have the ability to buy an entire BTC coin, you can purchase a portion of it by spending the amount of money you have.

The smallest part of it is called a satoshi and is one hundred millionth of a bitcoin (0.00000001 BTC), and one dollar can currently buy 3,500 satoshis.

Holders of 10 million satoshis or 0.1 bitcoin will be the custodians of a great fortune.

The catch is that bitcoin mining will one day end, and the losses will continue. Given the growing number of users and turnover of cryptocurrencies, this could lead to almost inevitable deflation, and the price of BTC will only rise from this!

But why is the number of BTC so severely limited to 21 million? First, it is due to the principle of limited money issuance, an essential aspect of economics similar to the gold standard. No one can arbitrarily increase the amount of money, and inflation will be spread evenly to all participants, regardless of individual countries or groups.

Second, the number 21 has symbolic significance is often associated with positive events or achievements, and is also the age of adulthood for many people.

Thirdly, it all correlates with the need for a new world government in which 3% of people will own 96% of the world’s wealth. On the day Bitcoin was created, about 7 billion people were on Earth, of which 3% were very wealthy. It means that about 210 million people may still be wealthy in the future. Only now, they will own bitcoins and will be completely different people. So, about 21 million people are potential holders of 21 million BTC.

Security

We’ve talked quite a bit about Bitcoin but still haven’t figured out why keeping money in this digital currency is so secure.

Bitcoin uses 12, 15, 18, 21, or 24 words as standard options for generating a seed phrase. The most common and recommended length of a seed phrase is 12 words. These words are chosen from a predefined list of vocabulary words known as the BIP39 (Bitcoin Improvement Proposal 39) dictionary. Using a seed phrase allows wallets and their private keys to be recovered and recreated if the device is lost or damaged. 5,444,517,870,770,770,735,735,974,381,410,031,699,376 (five and a half quintillion) unique seed phrases can be generated from a list of 2,048 words in length, using a minimum of 12 words in each seed phrase.

To understand – if some person wants to guess your phrase, he will have to go through 680,564,733,842,966,996 combinations.

Assuming his server will process one variant per second, he has to live 21,598,892 years or use 21 million computers for an entire year! With such a resource, there is no need or logic in searching for someone else’s wallet, as you can spend resources on mining new BTC. This calculation is made for a seed phrase of 12 words, but I couldn’t even write a 24-word seed phrase calculation. Otherwise, the resulting number would take up half a page!

Example of a keyword phrase (seed phrase):

«dynamic modify glow puzzle primary ivory chair tank spray whisper echo timber.»

Example of a public address:

1BvBMSEYstWetqTFn5Au4m4GFg7xJaNVN2

Add to this Bitcoin’s code as a program consists of 77,000 lines. The 70,000 lines are written in the programming language C++. In addition, the length of the chain in the Bitcoin blockchain has exceeded 710,000 blocks. To guess the bitcoin phrase to crack all the blocks will take over 38 nonillion years because the system has acquired a reliable cryptographic hashing algorithm – SHA-256. And that’s another reason why no one has been able to crack Bitcoin yet.

Not everyone has heard of SHA-256, but in my opinion, it is one of the greatest American inventions of the 21st century. Developed by the National Security Agency (NSA) in 2001, SHA-256 is a secure hashing algorithm used in the iPhone to hash data, including the unique facial characteristics many of you use to unlock your phone.

I won’t bore you with the details, but SHA-256 has never been broken or compromised, making Bitcoin one of the most secure protocols in the world. That is why it was decided to create a digital asset based on it. In 2010, SHA-256 was said to «have the potential to last several decades unless a large-scale breakout attack occurs.» That is good news, as Bitcoin was designed to be mined and stored for the next 140 years, maybe even longer.

Remember that there is currently no hardware capable of damaging Bitcoin. The only thing that can damage it is the «51% Attack», in which an attacker captures more than half of the network’s mining capacity.

The 51% attack is a potent threat to blockchain networks, including Bitcoin. It occurs when a single participant or group of blockchain participants control more than 50% of the network’s computing power. It means they can manipulate the transaction validation process and create fake transactions.