Полная версия

Use of features of the taxation of small business in the USA for modern RUSSIA

Сергей Каледин

Use of features of the taxation of small business in the USA for modern RUSSIA

USE OF FEATURES OF THE TAXATION OF SMALL BUSINESS IN THE USA FOR MODERN RUSSIA

Kaledin S. Chelyabinsk State University. Email: kaledin.vip@bk.ru, phone +79080542272 (Russia)

ABSTRACT. Development of small business in the USA can be connected with a number of the reasons among which it is possible to call as the features of historical character connected with emergence and development of the United States and the reasons of tax character. So, in each state privileges on taxes which allow to organize in the best way by use of tax planning business can be established. It is represented that the institutionalism is indissoluble with the taxation as in the taxation there are institutes, customs, for example, regarding check of conscientiousness of the taxpayer, use of the special tax treatments and the habits, so at many businessmen and the companies became a habit earlier to pay taxes, to form an overpayment on taxes for the purpose of decrease in risks of additional accrual of penalties, others opposite, created a habit of a conclusion of the capitals abroad to low-tax territories for the purpose of decrease in the tax load. The purpose of formation of institutes is decrease in negative tendencies in the taxation, institutes are capable to improve process of the taxation, including taxation of small business. Improvement of tax administration in the sphere of small business assumes development and realization of actions which, on the one hand, allow to simplify system of tax administration, to reduce a number of hours, spent by taxpayers for stay in taxing authority. At the same time tax administration allows to apply the special modes to small business and to lower administrative load of small business. In various countries various mechanisms of simplification of tax administration for micro and small enterprises are used, a number of mechanisms can be effectively used in the Russian Federation.

Key words. Small business, taxation, collecting of taxes, tax concessions and advantages, Institutsializm, taxation of small business, tax payment, collecting, small enterprise.

INSTITUTIONAL APPROACH TO THE TAXATION OF SMALL BUSINESS

The Nobel laureate D. Nort "considers institutes as a set of rules of conduct of individuals, this approach includes the formal laws, and also informal contracts, codes of behavior, restriction drafted by people, and also coercion factors, such as institutes of civil society"1. On the other hand the institutsializm incorporates two important concepts: "institutions" – norms, customs of behavior in society, and "institutes" – fixing of norms and customs in the form of laws, the organizations, institutions"2.

The founder of institutionalism it is considered to be Torsteyn Veblen. The term "institutionalism" was developed by the American economist U. Hamilton in 1916 and defines institute "as a verbal symbol for the description of group of public customs, a way of the thinking which became a habit for group of people or custom of the people"3.

"The world of customs and habits for which we adapt our life represents a texture and indissoluble fabric of institutes"4.

John R. Commons5 defines "institute as collective actions for control, release and expansion of individual action". Its forms are:

– unorganized custom;

– organized actions of the enterprise.

And the institutional economy is represented to it behavioural, and behavior of individuals in the course of participation in transactions.

The behavior of businessmen and the organized operating small enterprises within institutional economy can differ.

Within the economic growth, simplification of tax administration, simplification of procedures of business of action of small business entities are directed on:

– registration of the new companies;

– increase in jobs;

– tax payment and collecting;

– conscientious execution of the duties before the state.

In the conditions of economic contraction and crisis, increase in taxes which are not able to pay small business entities actions of small business entities are opposite and directed on:

– closing of the companies;

– dismissal of workers;

– leaving from tax payment;

– creation of schemes of minimization of taxes and tax payment in other countries with the established lower rates of taxes and fees.

The behavior of an individual, and also collective behavior can be aimed at the development of institutes of small business, development of business with simultaneous cultivation of culture of tax payment and collecting. For this purpose observance of a number of conditions, such as cultivation and strengthening of enterprise culture, simplification of procedures of business, simplification of procedures of tax payment, and also the help in tax payment, submission of declarations and establishment of interaction between the state and the taxpayer at the confidential level is required. It is possible to agree with Suleymanovy M.M.6 which considers institutional aspect from the point of view of social justice, economic efficiency, uniformity of distribution of tax base. From the point of view of the individual entrepreneur and the subject of small business, the microenterprises the taxes paid by the specific subject of economic activity have to be spent effectively, including taking into account further priorities of business, such as development of infrastructure, highways, support of socially oriented and manufacturing installations. Social justice from the point of view of small business entities is the indicator of efficiency of a collecting of taxes. Gordeeva O.V. notes "fiscal regulation as the tool of the institutional environment has high chances of big efficiency in the sphere of support of MSP"7.

Factors of the demotivating behavior of small business entities are factors of irrational use of the budgetary money, the crisis phenomena in economies, lack of culture of business, projects of increase in taxes and fees, and also emergence of non-tax payments in the budget which actually have the economic nature of taxes as possess the taxation object, have the established rates.

Institutional approach is considered by the Russian scientists not only from the point of view of social justice and economic efficiency. Matveeva O.E.8 suggests to use this approach for providing system of local self-government, saying that "approach allows to develop the idea of the operated institutionalization of system of local finance", and as the main method of transformation of financing offers decentralization of public administration. Lomtidze O.V., Tinyakova V.I.9 connect institutional approach with development of the financial market by implementation of regulation by governing bodies taking into account differentiation on groups of financial institutions and the functional principle. Movchan Yu.V.10 estimates a contribution of this approach at the level of the international interinstitutional agreements. Hafizova A.R.11 applies institutional approach to tax administration from the point of view of institutes of tax administration, institute of administration of the non-tax income, institute of administration of gratuitous receipts. Masur Yu.A.12 specifies that "taxes are the instrument of fiscal policy in the institutional environment". Thus, rather large number of the Russian scientists pay to institutional approach much attention.

At the same time, to the taxation of small business institutional approach did not find reflection in refraction. It is represented to the author that institutional approach has to be applied rather widely in the taxation of small business entities on the following bases:

1. In the Russian Federation small business is developed not enough, unlike other countries, where exactly small business makes GDP basis, in Russia often an assessment of a share of receipts from small business entities in the budget is not even given. At the same time, the Strategy of development of small and average business in the Russian Federation for the period till 2030 which realization is not possible without use of institutional approach to the taxation, improvement of institutes which purpose is development of small and average business was accepted.

However only by program and strategic methods without improvement of institutes of small business, without orientation on small business entities achievement of similar indicators is represented impossible. Thus, use of institutional approach which is based on development of various mechanisms including in the field of the taxation, will promote achievement of planned targets.

2. Institutional approach allows to exercise control of tax revenues as due to management of human behavior, creativity, involvement of the most active individuals for development of civil society, participation in an entrepreneurial activity, and by introduction of new standards of behavior, customs and at the same time created institutes. Business as standard of behavior of the individual allows to increase the number of the independently employed people, to reduce unemployment, to raise turnover of small business entities due to refusal of other work, increase in an involvement into business processes. At the same time the proliferation of small business entities will promote high-quality changes, such as increase in a share of GDP in terms of the number of small business entities, increase in a share of the taxes paid small and the microenterprises.

3. Institutional approach unites economic and legal bases of management of the taxation. Legal bases of institutional approach consist in legal custom and the precept of law, the economic component of institutional approach is based on individual actions of economic subjects. From the point of view of the taxation institutional approach allows to set customs in norms, so the obligation for tax payment, observance of ministerial procedures, such as timely statement on tax accounting, submission of declarations, use of the tax preferences and privileges provided by the state instead of avoidance of taxes in other countries has to become standard of behavior for small business entity. Similar behavioural norms are possible due to quality state regulation, decrease in administrative barriers, simplification of the taxation, and also assistance to those taxpayers which make mistakes in the taxation due to the lack of sufficient tax culture, knowledge in the field of the taxation.

4. Institutional approach can be used in the mode of the best preference as for small business entities at the level of development of separate institutes, centers of support of small business, the centers of training of small business entities, centers of tax administration, and at the level of the state. At the level of the state institutional approach can be realized as by strengthening of system of the taxation, institutes of civil society, increase in number of small business entities, and by increase in a collecting of taxes due to increase in culture of the taxation, development of steady customs in tax payment.

5. Institutional approach can consider as the registered norms, and unwritten rules, customs, moral standards, and can influence the deep reasons inducing the personality to fulfill the civil duties and to pay taxes. In general, by means of this approach, perhaps to change tax culture.

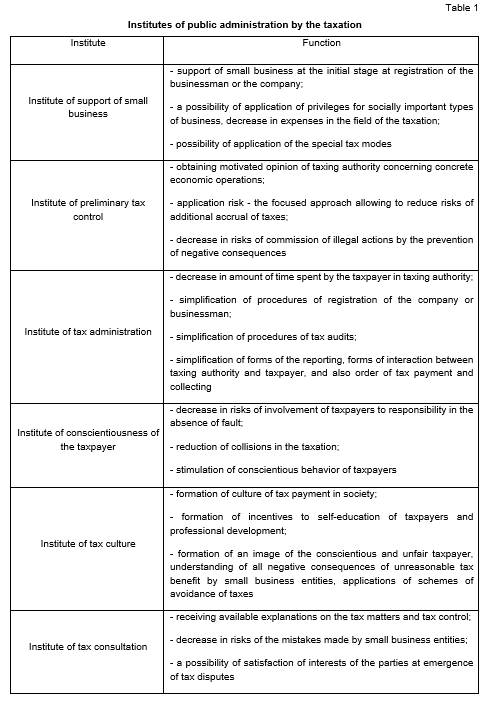

Authors see practical realization of institutional approach through a prism of development of tax institutes. As perspective tax institutes on a national level it is possible to allocate the following:

1. Institute of support of small business

The purpose of institute of support of small business is providing to small business entities the help in the organization of own business, consultations, including online consultations concerning use of the tax concessions and preferences, possibilities of decrease in tax base, and also training concerning correctness of business, the organization of relationship with public authorities. For the state introduction of the center of support of small and average business is provided by the Strategy of development of small and average business in the Russian Federation for the period till 2030, at the same time real information, organizational support will promote increase in number of small business entities, increase in turnover of small business entities and consequently, finally and the amounts of the paid taxes and fees.

2. Institute of preliminary tax control

Development of institute of preliminary tax control is provided in the Main directions of tax policy of the Russian Federation for 2016 and planning period of 2017 and 2018. According to the directions of development of the taxation by the purpose of development of this institute decrease in tax risks, stimulation of business activity due to increase in stability and granting additional guarantees to taxpayers is. From the state introduction of this institute will allow to reduce time of conducting tax audits, and also will reduce the risks of the state connected with tax avoidance.

At the same time, now the institute of preliminary tax control assumes distribution on large taxpayers, however small business entities cannot use this institute. In this regard expansion of use of institute of preliminary tax control on small business entities would allow to increase culture of the taxation, to establish interaction between small business entities and the state on a constant basis, to lower a distance between requirements of small business and the state, and also to carry out on a constant basis monitoring of problems of business from the point of view of the taxation.

3. Institute of tax administration

As practically worldwide the institute of tax administration is given great value, in the Russian Federation this institute also has to develop dynamically within institutional approach. Among noticeable measures for improvement of institute of tax administration it is possible to call introduction of electronic document flow, introduction of new services, such as a private office of the taxpayer, introduction of a possibility of obtaining information on contractors online, such as certificates of incorporation. At the same time, the institute of tax administration is subject to further improvement by technological development, decrease in administrative load of small business and the microenterprises, simplifications of system of submission of the reporting. Besides, according to the strategy of development of small and average business in the Russian Federation for the period till 2030 predictable fiscal policy has to gain great value. The predictable fiscal policy based on stability of system of the taxation not introduction of additional non-tax obligations and the additional charges in territorial subjects of the federation will allow to increase coefficient of "birth rate" of small business entities.

In particular, now individuals are interested in that the taxation was the simplest and clear, considered interests of society.

4. Institute of conscientiousness of the taxpayer

The institute of conscientiousness of the taxpayer has indirect fixing in the Tax code, however the taxpayer needs to prove in practice that he did not receive unreasonable tax benefit, carried out an inspection of conscientiousness of the contractor. But unlike the large companies small business entities often have no in staff of the workers specializing in the tax matters, in this regard can not always prove conscientiousness and lack of unreasonable tax benefit at implementation of transactions, operations. Development of institute of "conscientiousness of the taxpayer" will allow "to idealize" a positive image of the conscientious taxpayer. Idealization of an image of the taxpayer who is paying taxes, carrying out investments into development of the country will allow to create an ideal image of the economic subject who is honestly paying taxes. Now within work of the website of tax administration, media, information on the Internet form the return image of the unfair taxpayer concerning which the tax audits revealing million debts to the budget concerning which criminal case is brought are carried out. For small business entities development of institute of conscientiousness of the taxpayer would allow to increase confidence in a possibility of business, forming of business processes without risks of additional tax audits, involvement of specialists in the taxation and contest of actions of taxing authority in pre-judicial and a legal process. For the state development of institute of the conscientious taxpayer will allow to make business more attractive to citizens, to increase appeal of business and to improve perception of tax risks for small enterprises.

5. Institute of tax culture

Development of institute of tax culture is very important for the purposes of development of civil society and improvement of a collecting of taxes. In particular, Sadchikov M.N.13 pays attention that lack of tax knowledge is the limiting factor for decision-making, at the same time the low level of tax culture is the reason of tax avoidance. Grigorieva E.N.14., in turn, supports "realization of ideological function of the state as formation and education of patriotic fiscal sense of justice".

For taxpayers development of institute of tax culture will allow to increase knowledge in the field of the taxation, to create steady opinion on need of tax payment. For the state introduction of ideological function and development of institute of tax culture will allow on the one hand, to increase quality of state regulation, and on the other hand, will make unacceptable tax avoidance. Improvement of tax culture is possible by development of special public seminars, programs for television, introduction of special objects and courses in educational institutions will allow to develop effectively customs of tax payment for all taxpayers. Development of ethical standards in the field of the taxation will also allow to create as moral and ethical standards in the companies, non-profit organizations, in the consulting companies representing services in the taxation ethical standards regarding tax payment. In particular, the similar mechanism actively develops in the United States of America where in connection with existence of the anti-corruption legislation Codes of ethics accepted the leading corporations and the companies. Improvement of tax culture will promote development of moral standards in society in the field of the taxation.

6. Institute of tax consultation

Within "road map" "Improvement of tax administration" (the order of the Government of the Russian Federation of February 10, 2014 of N 162-p) is provided preservation of voluntariness of tax consultation at simultaneous increase in overall performance of taxing authorities.

A number of authors sees positive tendencies in development of tax consultation. So, Aytkhozhina G.S.15, notes that tax consultation acts as "real instruments of constructive dialogue, mutual trust, interaction between interested parties will promote improvement of quality of the tax relations, voluntary observance of the tax legislation, formation of sustainable development of society", at the same time paying attention to insufficiency of the service received by the taxpayer. Work as Shuvalova E. B. is devoted to a question of tax consultation., Yefimova T.A.16, they note that tax consultation arose in the 60th years of the 20th century as the sphere of business, at the same time the profession of the tax consultant appeared in Germany in 1919.

At the same time in some countries, such as Hong Kong, Singapore, Great Britain private institutes of tax consultation develop, associations of tax consultants appear, so, in Europe similar association (The European confederation of tax consultants) was based in 1959, in particular, such countries as act as participants given the organizations: Austria, Belgium, Bulgaria, Croatia, Czech Republic, Finland, France, Germany, Greece, Ireland, Italy, Latvia, Luxembourg, Malta, Poland, Portugal, Romania, Russia, Slovakia, Slovenia, Spain, Switzerland, Netherlands, Great Britain. The similar organizations allow to develop uniform standards of tax consultation, including at the international level. In a number of the countries development of tax consultation develops by means of the state consultation, it is possible to carry the Czech Republic, the USA to such countries.

In a row a camp questions of tax consultation are so important that the question of tax consultation is regulated by the special act, special standards. In some countries the question of tax consultation is built on a scientific basis, so in Great Britain the Royal institute of the taxation (CIOT) works. This institute was founded in 1930 on the basis of the Royal Charter that speaks about the importance of this establishment. Very important direction in activity of this institute is development of professional standards of activity in the field of tax consultation that allows to increase efficiency of tax consultation. At the same time the existing standards of tax consultation fix a priority of activity of the state over a business priority in Great Britain, so the tax consultant has to estimate without fail public interest from the point of view of suspicions on criminal activity or money-laundering and to report about these facts.

In general, development of institute of tax consultation both on private, and on a national level for small business entities allows to increase tax culture, to resolve controversial issues in the taxation, to avoid tax risks of additional accrual of taxes, to reduce risks of decision-making in the presence of collisions in the taxation. For the state development of institute of tax consultation allows to increase quality of the recommendations provided to taxpayers to lower cases of providing low-quality consultations which can mislead the taxpayer, create collisions in the taxation.

The institute of tax consultation is closely connected with formation of behavior of taxpayers. Tax consultation on a national level, promotion in media, work with taxpayers concerning establishment of an image of the conscientious taxpayer set as the purpose an exit from a shadow of small business entities, increase in consciousness of taxpayers, and eventually – increase in a collecting of taxes. According to Yakupov Z. S. "institutional approach has to be characterized by aspiration to achievement of such level of mutual trust between the parties when not only sanctions, but also incentives against accurate and conscientious tax payment17"are urgent.

Authors allocate the following institutes of public administration by the taxation aimed at the development of small business

Except a national level institutional approach can effectively be used at the level of small business entity in the following directions.

1. Institutional approach at the level of internal tax control

Carrying out internal control is fixed for accounting (article 19 of the Federal law of 06.12.2011 N 402-FZ "About accounting"), for the taxation carrying out internal tax control is not enshrined in the Tax code. It means that the economic subject can independently make the decision on carrying out internal tax control and defines the list of the actions necessary for tax control. Such experts as Kalinicheva R.V., Makarova N.N. pay to a question of institutional approach to formation of system of tax control attention, noting that "institutional approach to statement of system of internal control is based on the mechanism of management of intra-corporate transactions"18.

At the same time, statement of system of internal control at the level of small business entity it should not be limited, according to the author, only to intra-corporate transaction. The system of internal tax control based on institutional approach has to include verification of mutual settlements with taxing authority, check of conscientiousness of contractors, verification of transactions regarding tax risks, tax planning regarding tax payment and collecting in the budget, identification of mistakes and risks of untimely performance of the tax obligations.

Kakovkina T. V. notes that "the foreign model of internal control in many respects is defined by existence of system approach and recognition as the main subject to control – risks"19. Such approach can take place and be used by small enterprises for assessment of risks of additional accrual of taxes, control of risks during the checking of conscientiousness of contractors, assessment of concentration of tax risks. The risk-focused approach at the level of small enterprises will allow to reveal in due time tax risks and to make decisions which will allow to reduce risk of additional accrual of taxes and fees, a call of taxpayers on the commission concerning losses and the salary commissions, risks of penalties and a penalty fee.