Flash Crash

For more than a century, futures were principally traded at the Chicago Board of Trade and the Chicago Mercantile Exchange, but in 1979 Margaret Thatcher was elected prime minister of Britain, ushering in an era of buccaneering capitalism and deregulation. Three years later, a European market focused solely on financial futures – instruments tied to the future value of bonds, equities, foreign exchange and interest rates as opposed to commodities like wheat or copper – was born. Liffe started out at the Royal Exchange, a grand, cavernous, rectangular coliseum directly opposite the Bank of England. When it was built as a venue for merchants to congregate, in 1571, financial traders were banned because of their ‘rude manners’. Four hundred years later, they had taken over.

The first participants through Liffe’s doors were given the honorific ‘Day One Traders’. They included David Morgan, a serial entrepreneur who owned a boutique on Carnaby Street and, according to the legend, made a fortune selling dried fish to Nigeria in the 1970s. Morgan was a small, regimented man with a suave bearing and a tightly clipped moustache that earned him the nickname Colonel. Traders saluted him as they passed. Morgan wasn’t the greatest trader himself, but he could recognise potential in others and started backing new recruits, many of them high-school graduates from working-class backgrounds. They adored him, happily sacrificing a share of their profits for the opportunity to make a fortune.

Paolo was among them. Brought up with his brother in south London by their mother, a housewife, and father, a police detective, Paolo found school easy and took his maths exam early, but he was restless, and when his friends went off to university, he landed a junior role at the Bank of England. After a couple of fusty years behind a desk learning about interest rates and yield curves, he got a position at a merchant bank, where he worked in a department that used futures to hedge its portfolios. One day a broker invited him on a tour of Liffe. They met by the Royal Exchange’s towering stone columns at 1.25 p.m., five minutes before a big economic announcement was due to be made.

‘Even now, thinking about it, the hairs on the back of my neck stand up,’ Rossi recalls. ‘You walk in there and the first thing that hits you is the electricity. And then the noise. Everyone is shouting at each other. All arms and hands in the air, people trying to get people’s attention, girls in booths screaming. It was like going from total silence straight into Wembley Arena for the FA Cup final. I instantly knew I wanted to be there.’

Inside, business was organised around a dozen or so crammed, sweaty, lightly sloping pits where the buying and selling took place. For eight frantic hours a day, traders carried out a relentless stream of orders relayed to them in hand signals from booths running around the edges of the room. Then, when the market closed, the place would empty out and the pubs would fill up. Liffe’s ecosystem was made up of three broad species: brokers from firms like JPMorgan and Goldman Sachs, who wore multicolored jackets and acted as intermediaries, executing orders that came in by phone from customers including global corporations and pension funds; runners, who sported yellow and ferried around messages while trying to avoid projectiles and abuse; and, at the top of the food chain, the red-jacketed ‘locals’, speculators who carved out a profit buying and selling for their own accounts. They had a reputation for being ruthless, but in always standing ready to take one side of a trade or the other, they provided that essential quality to any market known as ‘liquidity’.

Rossi quit his job and took a pay cut to take up as a runner with David Morgan Futures. Within two years he was trading and by the age of twenty-six he was a local, buying and selling German government bond futures in the ‘bund’ pit, the biggest and most aggressive of them all. Before long he started his own firm, backing a new generation. Recognising the stars of the future wasn’t easy. The atmosphere could be confrontational – according to myth, a Chicago trader was once left sprawled on the floor after having a heart attack while business carried on around him – and owners often hired beefy individuals or former athletes who could hold their own in a crowd. But some of the most successful, like Rossi, were soft-spoken and physically unimposing. A grasp of economic theory was less important than mental acuity, decisiveness, stamina, a thick skin and the power to influence others. It helped, too, to have a healthy disregard for the value of money.

Rossi’s approach was to trade constantly in an effort to pick up information and build a holistic picture. ‘Sometimes you don’t have a view, but if you take a position, even it’s just one lot [a “lot” is a single contract], you can learn something. Don’t just stand there. Buy or sell it, how does it feel? You’d be amazed how many times you buy a one-lot and think, “I hope it goes up,” and then you see it’s never going up and you end up selling ten lots. So that one lot helped you make a decision and you go from there.’

Relationships were crucial. Brokers with big orders to fill went to preferred traders first, and some eagle-eyed participants sought to jump ahead of incoming orders – an illegal but inescapable practice known as ‘front-running’. The ultimate goal, though, was to become so big you could bully the market simply by taking a position and watching the minnows line up behind you on the assumption that you knew something they didn’t. The risk of ruin was ever-present, but the rewards for those who reached the highest echelons were great. ‘I remember when I made my first million,’ says Rossi. ‘I was twenty-six and I said to one of my mates: “The next hundred grand I make I’m treating myself,” and I did. I bought a Ferrari.’

The next decade was all fast cars and fast living for Rossi and the other traders, who were christened ‘Maggie’s Boys’ owing to their affiliation with Thatcher. The press called them yuppies, but in another life many of them would have been plasterers or carpet fitters. For a while, they seemed invincible. In 1997, a statue was erected outside Liffe’s new premises immortalising the futures trader in all his pomp: a man (even in 2018, only an estimated one in eight traders were women), mobile phone in one hand, tie loosened, the hint of a smirk on his lips. Today it sits in a museum, a fitting metaphor for the pit trader’s fate.

Most historians of financial markets agree that the first time a security was bought using a computer was December 1969. However, New York technology company Instinet’s primitive share-dealing system was so far ahead of its time it would struggle to gain traction for the next two decades. Computers could line up buyers and sellers more quickly and cheaply than men in bright jackets, but they were also susceptible to malfunctioning and were less adaptable to the kind of freak occurrences that markets tended to throw up. With so much money at stake, entrusting multimillion-dollar orders to a machine wasn’t worth the risk – at least not according to the vested interests at the banks and brokerage firms that were happy with the status quo.

It took the crash of 19 October 1987 to force a shift. On what came to be known as Black Monday, the Dow Jones Industrial Average dropped 23 per cent, wiping a trillion dollars off the wealth of ordinary Americans. The postmortem revealed that many brokers, desperate to contain their losses, had stopped answering their phones when clients called. The industry’s reputation took another battering a couple of years later when the FBI indicted forty-six brokers and traders from the Chicago futures exchanges for fraud and front-running. The trusty market makers had floundered, and before the decade was out new systems proliferated allowing dealers to transact with each other electronically. For a long time, ‘open outcry’, with its runners and hand signals, existed concurrently with electronic systems. In the end, though, the spread of home computing and the Internet brought the plucky pit trader to his knees, eradicating the need for buyers and sellers to gather under one roof and opening markets to a new breed of stay-at-home investor. At Liffe, the end came slowly and then all at once.

The first shot of what came to be known as the ‘Battle of the Bund’ was fired in 1990 when Frankfurt-based Deutsche Terminbörse launched an electronic trading platform for futures. At first, Liffe ignored the threat. Then, when volumes started sliding, it dug in, extolling the virtues of open outcry and overhauling its fee structure. But when DTB announced it would let traders use its platform for free, there was an exodus. Liffe’s share of the all-important bund market went from 70 per cent in 1996 to 40 per cent a year later to less than 10 per cent a year after that. Every morning fewer and fewer traders showed up until finally, in August 1998, the bund pit was closed for good. Other markets quickly followed.

Rossi tried to offer a home to some of the diaspora, but few successfully made the transition, and an army of former pit employees found themselves displaced. Buying and selling futures on a screen should theoretically have been no different from doing it face-to-face. In reality, they were completely different jobs with different skill sets. For one thing, trading online was anonymous, which eradicated the importance of social dynamics and democratised the playing field. Brute force was no longer an asset when nobody could tell who they were dealing with. And the speed of transacting rocketed, rewarding fast reaction times and nimble fingers. Rossi cut his old stable loose, took a year off, and then started again.

NAV AND the rest of IDT’s new recruits gathered in Weybridge for the first time in May 2003. Combined with the first intake, there were around a dozen traders on the roster. Looking around the room, it was clear they were a diverse and well-educated bunch, albeit entirely male. There was Vikash Rughani, a plummy-voiced cricket fanatic with a master’s from Henley Business School; Shiraz Hussain, a quiet, industrious type; Chris Morris, a tall, well-mannered Brit who probably should have been working at a high-end bank in the City; Petros Josephides, a grinning, barrel-chested Cypriot with a booming voice; and IDT’s golden boy, Bradley Young, a gregarious Aussie who could walk into a bar knowing no one and leave with a girl on his arm and ten new best mates for life.

‘Nav was from a very different background to the rest of us,’ recalls one of the recruits. ‘We were all middle-class, educated, pretty international, and then there’s this kid from a very working-class background. He wasn’t professional. He couldn’t hold a conversation and come off like a normal person. When he spoke he made these weird comments. We used to call him “The Chav”.’

For eight weeks, Nav’s group was taken through the theoretical underpinnings of trading in IDT’s poky classroom. A former Liffe trader led classes on economics, markets, financial products and risk management, and set homework assignments reading classic texts like Market Wizards, Reminiscences of a Stock Operator and Steidlmayer on Markets. Goldberg gruffly explained the nuts and bolts of placing and cancelling trades using the trading software. Paolo regaled the group with war stories. They learned how to read charts and gauge market profile, and discussed the importance of psychology by examining the crowd effect, the history of various market crashes and seventeenth-century Holland’s tulip mania. During the training period, the rookies were paid £500 a month, a large chunk of which was taken up just making their way to the hinterland of Weybridge. To make ends meet, they waited for sandwiches to be discounted in the Waitrose downstairs and ate them in the vacant office next door. Still mostly in their early twenties, the recruits had few responsibilities outside IDT, and they became close quickly. ‘It was like the army,’ says one member of the group. ‘We were all in it together with no money and these big dreams.’ But while Nav would joke around in class, he split off from the rest of the group at the end of the day when they went to the pub to unwind.

After a couple of months, the new intake was let loose on a simulator, buying and selling futures at live prices. Each morning they were given a new challenge: one day they could place only one trade; the next they were given unlimited transactions; sometimes they traded futures tied to stock indices; other times, they practised on the bund. It was amazing how easy it was to make money when they had no skin in the game, and before long they were desperate to test their skills with real cash. Only Nav seemed content to keep watching the market and its eternal possibilities.

In his group, Josephides showed the best results on the demo and was the first to be unleashed with real money. With a big smile plastered across his face, he began taking positions using the interface. But this time, unlike over the past few weeks, every time he placed a trade the market seemed to move against him. His classmates watched as Josephides’s account fell below zero, then sunk lower and lower. By 4:30 p.m., when the market closed, he was in the hole for £2,000 – money he would have to pay back to IDT before he could realise any profits. It was a painful lesson in hubris, and one they would all learn many times over.

CHAPTER 2

THE BOY PLUNGER

Everyone knew not to disturb Nav when he was trading. For eight hours a day he sat at a lone desk at the far end of the trading floor, his face inches from his screens, in what appeared to be a catatonic state. To block out the world, he wore a pair of red, heavy-duty ear defenders of the type favoured by road workers. He didn’t communicate with anyone. Only his fingers moved. Nothing existed beyond him and the market.

Professor Mihaly Csikszentmihalyi from the University of Chicago coined the term ‘flow’ for the kind of transcendental experience that takes hold when an individual is completely immersed in a task. It arises when we use skill to tackle something challenging, like chess or yoga, and is characterised by a sense of deep concentration, mastery and contentment. Time distorts, hunger and tiredness dissipate and any sense of the self dissolves into the ether. For a few blessed moments we forget who we are and simply react. Performance coaches strive to cultivate flow, but for some – those Csikszentmihalyi describes as ‘autotelic personalities’ – it comes naturally and isn’t tied to any yearning for money, status or validation. The doing is its own reward.

Before Nav joined IDT, he found he was able to play computer games for longer and with greater concentration than other people. He would wager hundreds of pounds a match on FIFA online, beating players in the top one hundred globally. That single-mindedness had some drawbacks. Nav was absentminded to the point of hazardousness. He regularly fell off the small, 125cc motorcycle he’d bought to drive to work, and was known to sit down and start trading with his helmet still on his head. But when it came to trading futures, Nav’s hyperfocus was a gift.

Three years into his time at IDT, the distractions had increased. In 2005, after outgrowing its Weybridge digs, the firm had relocated to Woking, a less salubrious commuter town a few miles to the northwest. Paolo and Marco changed the company’s name to Futex and rented an entire floor of the Cornerstone, a hulking 1980s concrete-and-brick box on the same block as a public toilet and a boarded-up pub called the Rat & Parrot. They ramped up hiring, taking on two classes of ten people a year, and lowered the entry requirements for new recruits. The training programme was also condensed. Within a couple of years there were forty or so traders of wildly varying abilities and backgrounds panning for gold and racking up commissions from first thing in the morning until late at night.

The office had a reception area, a breakout room, a kitchen and a classroom with a poster of Muhammad Ali. Paolo and Marco had their own offices. Everyone else sat on the trading floor, which was made up of a dozen or so rows of desks, divided down the middle by a walkway whose principal feature was a slightly sad-looking houseplant. The atmosphere ebbed and flowed with movements in the markets and news relayed through loudspeakers known as squawk boxes. It grew particularly febrile ahead of key economic announcements, such as employment figures, when Goldberg patrolled the floor shushing the trainees like an angry librarian. When the figure hit, the room exploded. The most experienced traders set the tone. Young, who by now wore flip-flops and board shorts to the office, had a habit of barking strings of Aussie-tinged expletives when things weren’t going his way. ‘I’ve done my fucking arse!’ was a particular favourite. One trader was evicted after punching a wall.

Nav found all this negativity and posturing counterproductive. ‘You’d hear people say stuff like “I don’t want to be trading,”’ he later told a friend. ‘Those things make you demoralised. If you don’t stop them going in then they’ll have an effect on you.’ Nav believed his emotional state was critical to his success, and he guarded it fiercely. ‘You’ve got to make your mind strong,’ he explained. ‘A lot of people subconsciously take out their self-loathing in the markets. Make your self-esteem high. Make yourself feel like you’re deserving of the money!’ Nav’s solution was to extricate himself entirely, taking a desk by the toilets at the far end of the floor, three rows from anyone else.

At Futex, the number of screens you had was a mark of honour. It was common for traders to have eight or ten, crammed with charts, news reports and flashing prices, as though they were guiding a spaceship. The thinking was that, by having a comprehensive view of the world, you would be able to make better decisions. Plus, it looked cool. As with so much else, Nav took the opposite approach. He stripped back his setup to just two screens, enough to fit the limited tools he needed to make money.

By now Nav predominantly traded the S&P 500 ‘e-mini’, a futures contract that tracks the Standard & Poor’s 500, the bellwether index comprising five hundred or so of the largest companies on the New York Stock Exchange and NASDAQ. As the share prices of US businesses rise and fall, so does the S&P 500, distilling the fortunes of corporate America into a single figure. To coincide with US opening hours, Nav arrived at the office just before 2 p.m., when most people were returning from their lunch break, and logged off after 9 p.m., when it had cleared out. More than $200 billion of e-minis are bought and sold on the Chicago Mercantile Exchange’s (CME) electronic platform every day, and trading volumes in the contract far exceed the amount of buying and selling that goes on in the underlying stocks. It is among the most liquid markets in the world, used by banks, companies, hedge funds and asset managers to speculate on the prospects of the US economy or hedge other investments.

Nav, like most traders at Futex, had very little interest in the outlook for corporate America, per se. He’d never visited the country, and he preferred reading football websites to the Wall Street Journal. He wasn’t an investor like Warren Buffett, seeking out undervalued companies by scouring financial reports and sales figures; and he wasn’t an economics expert, hypothesising over what the complex interplay of geopolitical events and interest rates might mean for the markets. His horizons were much shorter. Nav was what’s commonly referred to as a ‘scalper’, a trader who hops in and out of the market throughout the day, notching up small wins and positioning himself to clean up should there be a big swing one way or the other. At the end of almost every session, he made sure he had no outstanding positions – that he was ‘flat’, in the idiom of the trader. The next day he started afresh.

The value of a single e-mini contract – the minimum one can wager – is calculated by taking the current value of the S&P 500 and multiplying it by $50. In mid-2007, when the S&P 500 was trading at around 1,500, a single contract, or ‘lot’, was worth $75,000. The market moves in increments of 0.25, known as ‘ticks’, and, regardless of the current price, every 0.25 move is worth $12.50 per contract (0.25 x $50). So if a trader buys 100 lots at 1,500 (at a cost of $7.5 million), waits for the price to notch up a tick, and then sells, she will walk away with $1,250. Of course, not everyone has $7.5 million sitting around, which is where brokers come in. Brokers act as an intermediary between a trader and the exchange. Even in extremely volatile conditions, the S&P moves around by only a few per cent in a day, so rather than requiring their customers to put down the total size of their position, they ask for a smaller sum, known as ‘margin’, which is calculated to cover any potential losses. Even so, losses can quickly mount up. As a result, futures markets are almost exclusively inhabited by professionals.

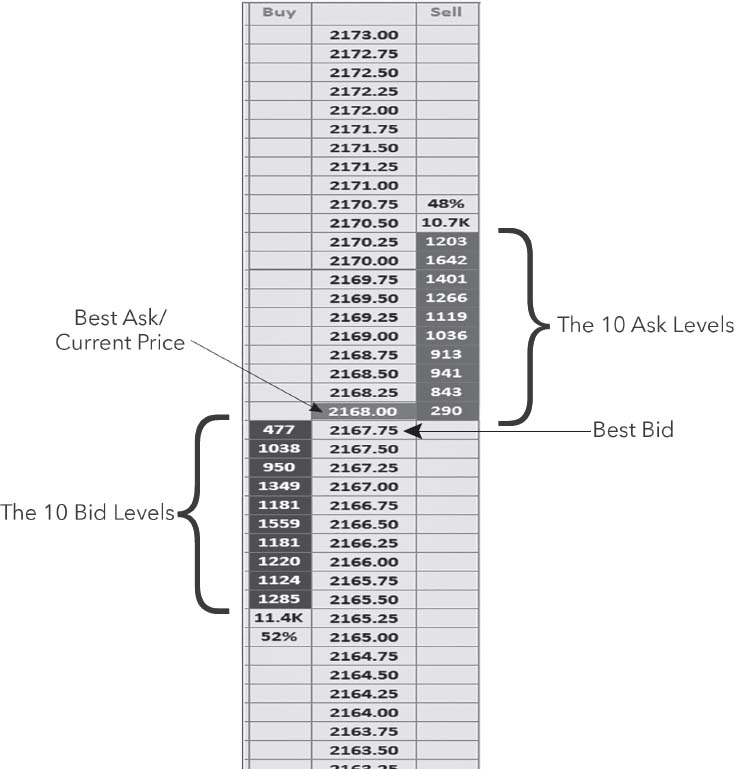

At any moment on any financial exchange there are two live prices: the current selling price, known as the ‘best offer’, which is the minimum anyone is willing to accept; and the current price to buy, known as the ‘best bid’, which is the most anyone is willing to pay. The difference between the two is known as the ‘bid-ask spread’, and in the S&P 500 e-mini, where the volume of trading is huge, it is rarely bigger than a tick for long.

To buy an e-mini on the CME’s electronic exchange, Globex, a trader must place an order, of which there are two main types. If she’s willing to trade at the current ‘best offer’ – let’s say it’s 1,500.00 – she’ll submit what’s known as a ‘market order’, and the transaction will happen immediately. However, if she wants to pay less, she can place a lower bid, at 1,499.00, say, and hope that the market comes down four ticks. This is referred to as a ‘limit order’. It can be cancelled at any time. Once the trader’s buy order of either type is executed, she is described as being ‘long’. To exit the trade, she simply sells the same quantity of e-minis, hopefully for more than she paid, after which she’ll be ‘flat’ again. A trader can also ‘short’ the market, or bet that the price will go down, by carrying out the process in reverse, selling some e-minis and then buying them back. (In trading, it’s possible to sell something you don’t actually own as long as you make good on it.)

The single most important thing on Nav’s screens was a display called the ladder, which shows trades occurring and orders entering and leaving the market in real time. Also known as the central limit order book, it looks like an Excel spreadsheet with three columns whose contents are constantly shifting. The central column contains twenty price levels, ordered from high to low. They range from nine ticks above to nine ticks below the current ‘best offer’ and ‘best bid’. Next to each level is a figure showing the number of orders waiting ‘in the queue’ to trade at that level. Taken as a whole, the ladder provides an indispensable window into a market’s supply and demand at any given moment.

Adjacent to the ladder on Nav’s screens was a simple price chart that plotted the e-mini’s rise and fall, which he used to gauge the overall mood of the market and find patterns that might repeat themselves. ‘It’s a graphical image of people’s fear and greed,’ he explained to a trader who asked him why he monitored it so closely. ‘That’s what you’re trading, people’s fear and greed. And they repeat themselves again and again. If it’s an individual, some may have more greed, some fear. As a collective, everything rounds off to something you can measure.’

The ladder shows trades in real time as they’re entering and leaving the market, offering an invaluable window into a market’s supply and demand. In this case, traders have placed orders to buy a total of 477 contracts at 2167.75.