Полная версия

The Stock Grail Disclosing the Secret. A Practical Guide

The Stock Grail Disclosing the Secret

A Practical Guide

Sergey Vladimirovich Gorneev

© Sergey Vladimirovich Gorneev, 2018

ISBN 978-5-4493-3157-1

Created with Ridero smart publishing system

Sergey Vladimirovich Gorneev

The Stock Grail

Disclosing the Secret

Izdatelskie resheniya

Under Ridero licence

2015

“The risk is only where there is a misunderstanding in the operation of the mechanism”

Sergey Gorneev

Acknowledgements

First of all, I want to express my gratitude to my parents for believing in me, for their care and support at any time.

To my family for believing in me. To my beloved wife Olya for support understanding and patience. To my colleagues. Without them all, without their help and support, you would not have kept this book. And of course, to all people who beneficially influenced me and my development path. It was challenging, but as it turned out it is achievable. On my way I was in many doubts, but thanks to the passion and my love for markets and environment, the enthusiasm was always there and it gave me energy to work. There were a lot of falls, disappointments, but confidence of success, confidence that I’m working heading in the right direction and hard work helped me to overcome all these difficulties.

The practical utility of the knowledge contained in this book i wrote for the whole world will be the greatest reward for me.

Sincerely yours, Sergey Vladimirovich.

So, let’s start the way of understanding the deepest mysteries of life.

ATTENTION!!! You can’t read this book quickly; it must be absorbed slowly, one page at a time and one chapter at a time.

This book contains materials that can completely transform your idea of the structure of the world and the laws governing it. Each chapter provides the basis for the next one. This book should be required reading sequaciously; you cannot jump from chapter another. The book is written in the accessible language.

INTRODUCTION

After publishing the first article in the magazine, which reveals the main points of the law of vibration, there were a lot of buzz in the Internet, most people were against what was written there. But as a result, none of the critics could refute the unbreakable truths that are disclosed in the article. It is the 2nd edition of the article published in 2012, only in the form of a book with a complete practical guide how to understand the stock markets and practically extract free money energy with high stability. In this edition the main emphasis is on even greater disclosure of the details of the fundamental part of the article, mathematical and scientific evidence.

Best regards. Gordeev Sergey Vladimirovich.

WHY IT BECAME NECESSARY

TO WRITE THIS BOOK

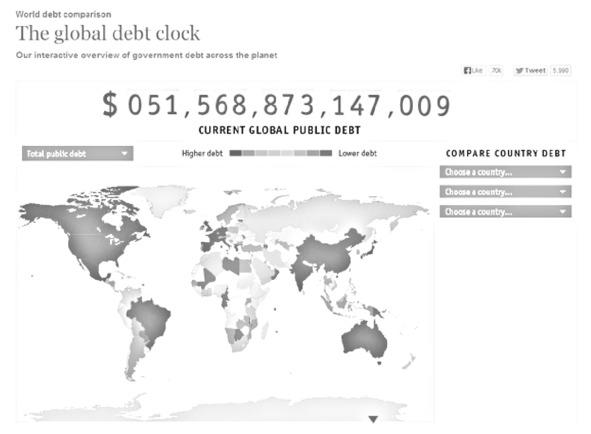

Currently social and financial crisis has engulfed the world.

But, unlike the social one, the financial crisis is the most threatening and the most tangible both in the general global economy, national economy, and in the stability of every person and family. Self-centered human development has reached the limit and entered into a process of self-destruction. The world is ready to accept alternative knowledge, in this regard, transfer of this knowledge was approved.

WAYS TO OVERCOME

Overcoming the financial crisis by participating in trading with the use of highly stable method of profit-making on the stock and OTC markets, which causes a strong imbalance in the global economy, in other words, the stock markets accelerated the collapse of the entire global economy, concentrating a huge reserves of vital energy. As well as the correct daily application of the fundamental law underlying any movement in the universe, from the microcosm to the macro, thereby raising themselves (their loved ones) and their lives to the highest level of balance with the surrounding nature.

Let’s consider the over-the-counter (OTC) FOREX market or simply stated “Currency market”.

In fact, Forex is not a market- it is a large currency exchanger and digital and graphical analyzer of the economies of individual countries and the global economy as a whole.

What attracts investors and speculators in FOREX?

Forex is advertised as the world’s largest stock market in terms of volume of transactions, in fact it is so, only 99.9% of all these transaction volumes happen between banks and usually not in order to obtain speculative benefits and about 0.1% is devoted to speculation that are held near the market. On the one hand, it is very tempting. You can make a big profit with the large volatility and liquidity. In terms of the tip of the iceberg it is so. Let’s take a look at what is hiding under the water, see the reverse side, which is so little said by all those who promote FOREX so fiercely.

In fact, any national currency in the world

is initially a loss-making enterprise because they suffer from mass loss as time passes. This loss is expressed in inflation (money depreciation), the reason for the depreciation of money lies in the imperfection of the credit system (but this is a separate topic). When you buy foreign currency for permanent holding, the probability that the exchange rate will rise or fall is 50/50, such probability is inherent in any activity where you do not know for sure whether you will make a profit or not.

So, buying a currency of any country, of any year, you will lose on the average 5% of its acquisition (inflation costs). The chance you have as an investor to make a profit or even keep the initial investment in the Forex market from a mathematical point of view is -1 (minus one) at the end of the year. And now think about how minus can be turned into plus through a mathematical formula that can be applied to the stock markets. The answer is obvious, you have no chance to do it!

You can’t argue with math.:)

Now let’s talk about the stock markets

Exchange markets itself are created to develop a particular economic sector, through the financing of legal entities (companies, firms, entrepreneurs, etc.), for this exchange markets are primarily investment and only then, speculative.

What does it mean? The exchange market is formed from real companies of a particular economic sector, each company has people who work hard to develop this company. This development requires large funds that can be invited to the company from the exchange. If you buy shares of major companies, any industry or country and hold them for many years (in the long term perspective), then there are high chances that on the results you will make a profit, regardless of whether you predicted further exchange rate or not.

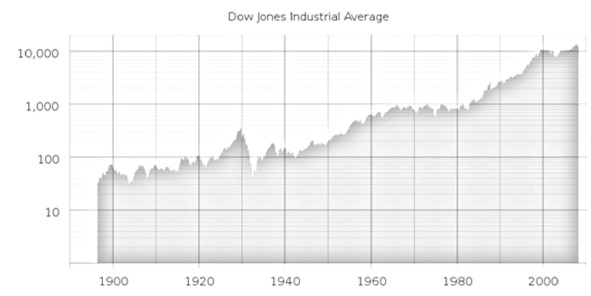

It follows that. Stock markets are in a positive mathematical expectation in the long term.

You can confirm tracing the index growth dynamics, for example, the “Dow Jones Industrial Average”.

The graph above shows that the index has been growing steadily for 100 years.

Let’s have a look on the speculative side of the exchange markets. The situation is as follows: the probability of a positive or negative outcome of each transaction tends to 50/50, and due to the fact that when entering the market, buying a security, you pay a transaction fee. It means that you automatically fall into a negative expectation, because you now need to earn to get a break-even on the transaction.

Hence the conclusion is that you have slight chance to make regular profit if you trade medium or short-term in the foreign exchange market or the exchange market. Unless you have a gift of prophecy and can see the future outcome.

So the question: How can it be possible to make profits from the stock markets on a permanent basis with a high degree of probability?

In order to achieve this task, it is necessary to turn to the fundamental principles that govern the universe, nature and all the processes taking place in the world and in

human life as part of this world (psychology, behavior, etc.).

There are many theories that somehow trying to describe the model of stock markets, but none of them can give an almost reliable method of making a profit on a permanent basis. In fact each of the theories describes only some part of the higher and fundamental model, which is a manifestation of the basic law governing the entire universe- the Law of Vibration. The Law of Vibration is the most important and basic law of the universe, to which everything in the universe is subject, including nature, men, and human activity as part of the general nature.

Here are some examples:

First, let’s define the concept of vibration:

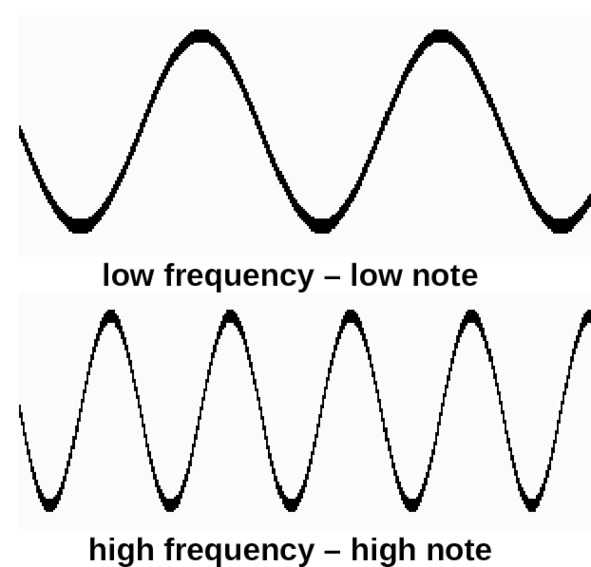

In the usual sense, vibration is a fluctuation with the cyclic characteristics.

The Wikipedia definition (free encyclopedia) is a repetitive process of changing the system status near the equilibrium point. For example, when the pendulum swings, its deviations in either direction from the vertical position are repeated.

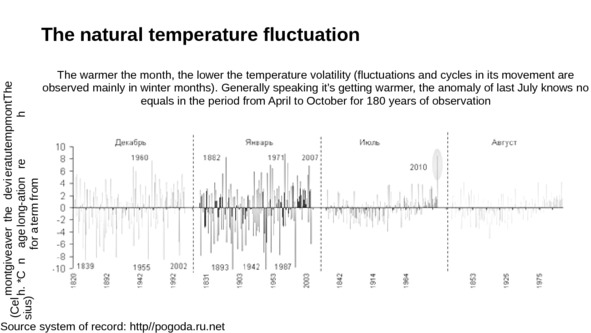

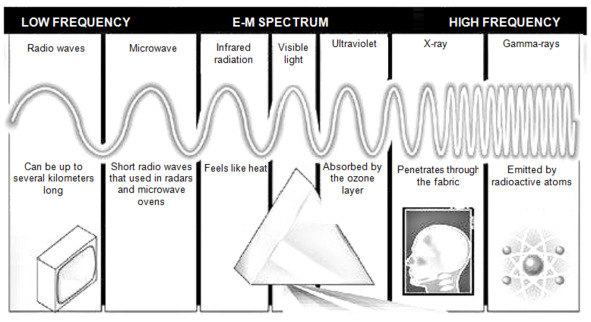

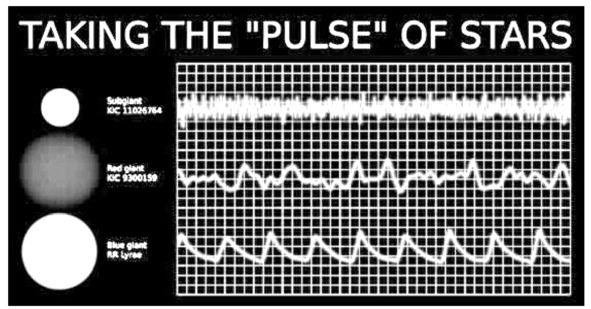

Vibrations come in different shapes and different frequencies, for example, radio waves, natural vibrations-waves in the waters, the waves in the air, fluctuation of plants in the wind, etc., the analogy in human life is the fluctuation of mood, heartbeat, life ups and downs, solar activity, etc.

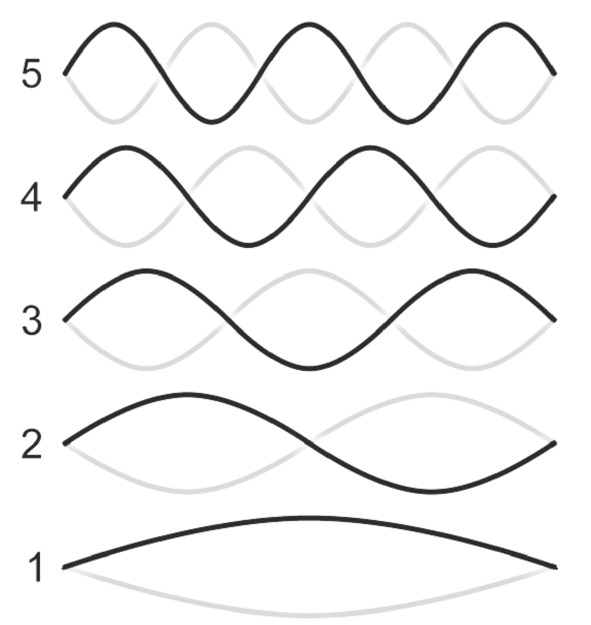

Also vibrations are multilevel (multi-frequency) and at each level the vibration frequency differs by the nature of vibration intensity

For example, different radio frequencies, the vibration frequency of smaller plants compared to larger ones, etc., the analogy in human life is different frequencies of human mood fluctuations from a smoother change to a more frequent time axis, heart rate, etc.

Also, the law of vibration is fundamental in the universe, if we consider, for example, starting from the molecule and sinking deep, then ultimately we will bump into only one type of energy.

It means that everything in the universe is energy, and the basis of energy is oscillation (vibration)

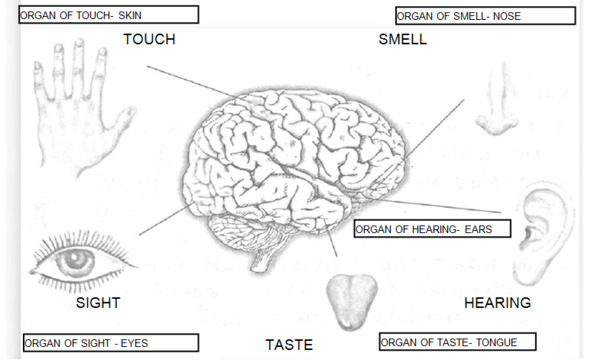

All matter, any consequence, behavior, thoughts and even all our reality, which we all perceive around, are just beams of energy which are transmitted by

our 5 senses (reacting to some external vibration effects, on them from the outside) to the brain,

where the brain interprets these fluctuations in feeling, feeling, vision, smell, hearing- it’s just different frequency and the manifestation of a common initial energy in different forms.

We receive information about the world around by 5 senses of perception

And also, any movement is a vibration, in relation to the surrounding space. For example, in the trajectory of planets, the vibration is the planet itself, which in motion perturbs the surrounding space of energy of a smaller frequency. After the planet goes through a certain point in the coordinate axis, after a certain time, the perturbed space tends back to the equilibrium that was before the planet went through it.

This example also illustrates the law of vibration in a certain form and frequency.

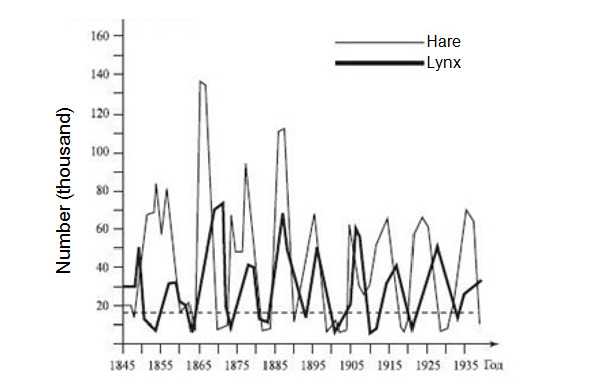

The oscillatory process is subject even to the process of animal population in nature, for example, the number of lynx and hares by year:

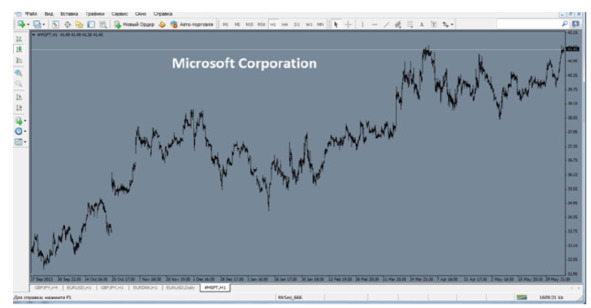

Now, knowing that everything in the universe is controlled by vibration, we can be sure that the stock markets, it is also vibration in the form of concentrated energy of a security, which is visually expressed in the form of financial quotes.

At a lower level, any change in the value of a security can be described by some economic and macroeconomic data, but at the highest level, all these data are just a consequence, a manifestation of the law of vibration, like everything in the universe.

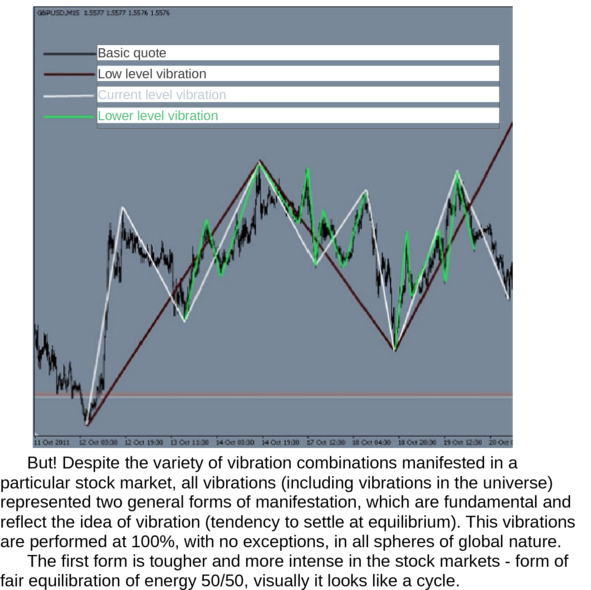

There are several forms of vibration in the nature of stock markets that are visually manifested in the financial quotes of a particular security. Here are its main forms:

Hereinafter will use stock terms “Bulls” and “Bears”. These two concepts separate those who trade for an increase and those who trade for a decrease in the price of security. “Bears” are the ones who sell. “Bulls” are the ones who buy.

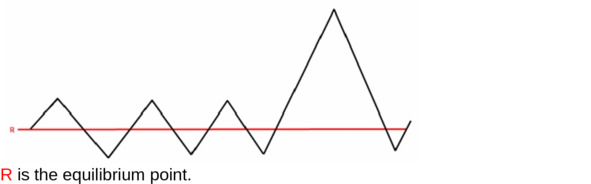

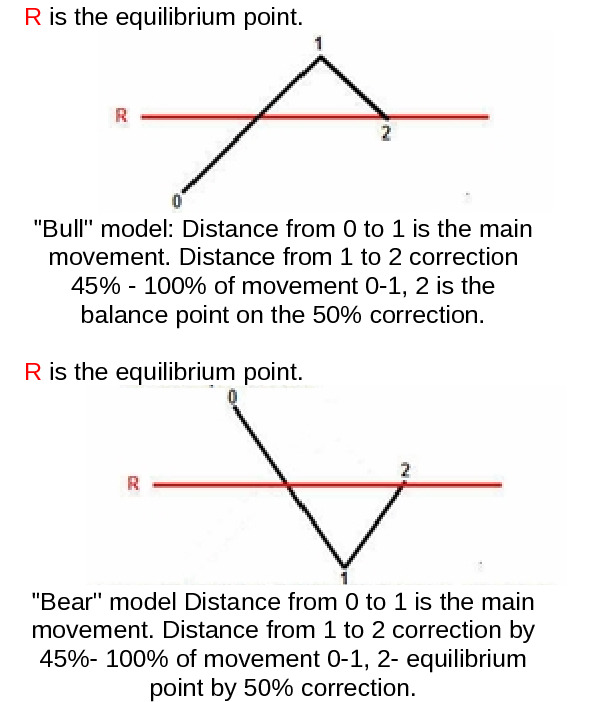

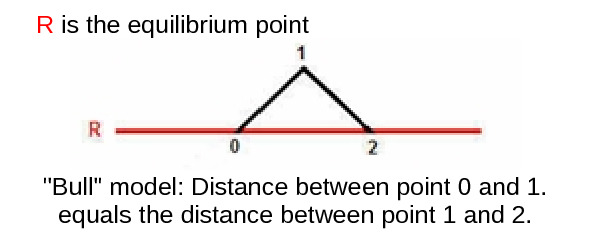

1) “Bulls” vibration model is the release of energy

We see a release of energy happened after the initial vibration in a specific range. But then after a certain period of time, the vibration returned to balance

R is the equilibrium point

Also, several vibration frequencies of a higher level and a lower one (in the form of noise) can appear on one time period.

This fundamental model is the basis, it can be found in any vibration type, form or combination.

Also, this model is fundamental to the law of the effectiveness of self-regulatory systems, which are the stock markets.

It means that the law of the effectiveness of self-regulating systems is a part of the general law of nature, the law of vibration, represented in the form of a fair balancing of forces, the probability of winning or losing- 50/50.

In the stock markets, this model looks like: Between “Bulls” and “Bears”, who in their daily trading practice use only some statistical data and do not take into account the law of vibration

the profit and loss probability distribution is approximately 50/50. 50/50 is the point of equilibrium, it starts the fluctuation of probability for the better, then for the worse in relation to successful trading, with a great inclination to the worst due to the strong competition of the masses of stock traders among themselves.

We can conclude that any method, any trading tactics, system, etc. which tries to predict the further movement of the stock markets and without taking into account the law of vibration, leads to the destruction. In fact, the world statistics confirm this, the world invented more than 5000 varieties of trading systems, tactics, methods, etc. that do not take into account the law of vibration, and they are useless, the general success is only 3%. The remaining 97% of stock traders end up either in the red or come to complete destruction, minority ranges at the black (around the initial trading deposit).

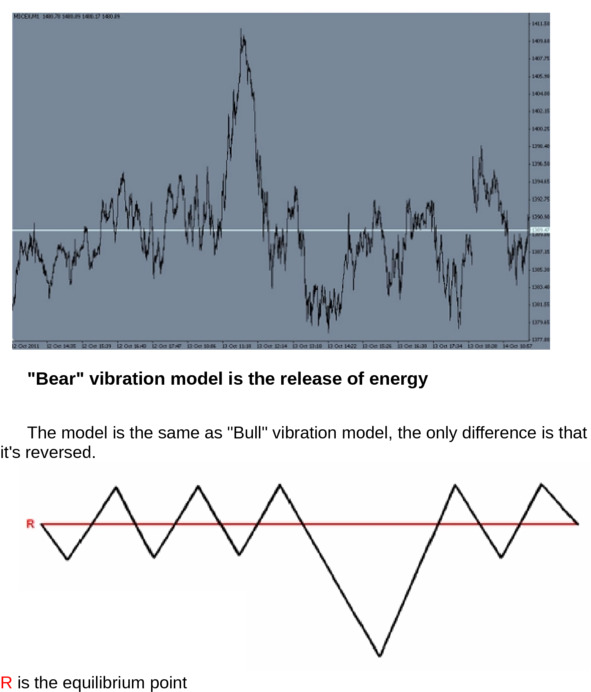

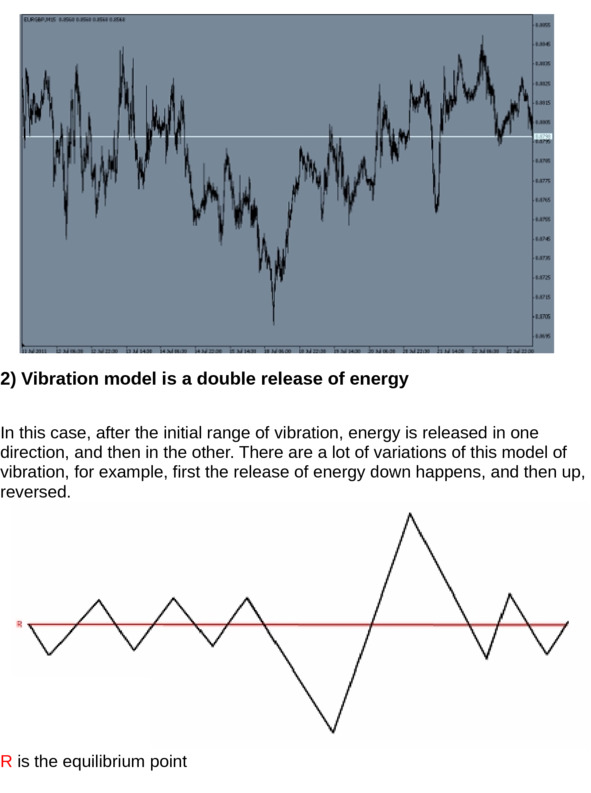

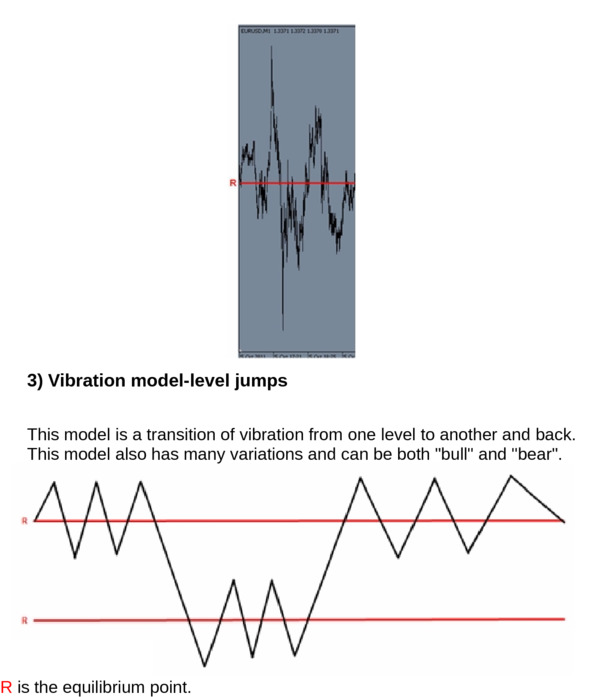

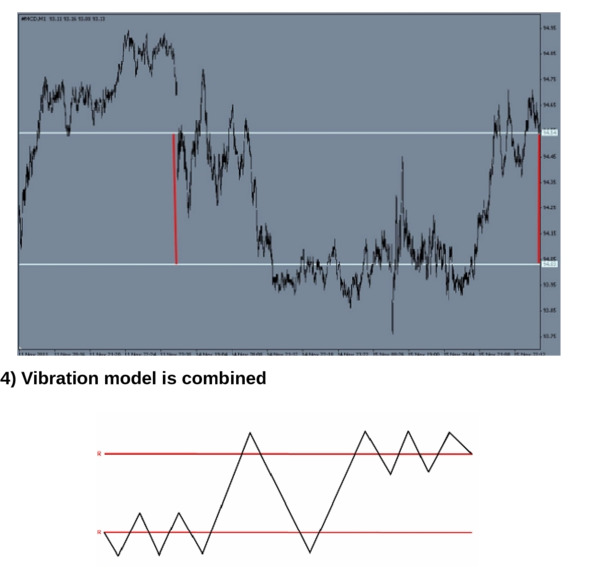

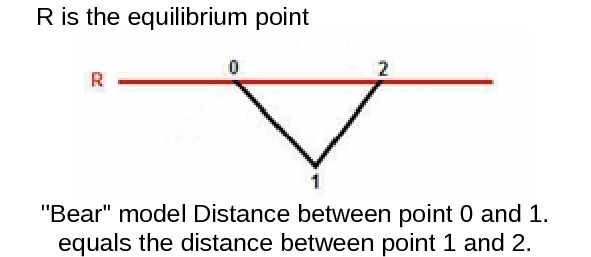

The second model of vibration in the stock markets is free and smooth along the horizontal axis of coordinates. It is represented in the reversed form.

Unlike the previous form of vibration, it can jump to a large number of levels up or down, relative to the previous cycle. Let’s have a look at the example below:

Each security has its main working frequency range. For example, main time periods: М1, М5, М15, М60, Н1, Н4, D1, W1. Each time period vibrates at its frequency. Vibrations with low frequency often convert to vibrations with higher frequency, as well as from a higher frequency to lower. The frequency range of each security is different.

For practical purposes we prefer 50% return model, it is more static than 100% return model, which is more dynamic in both the amplitude of the oscillation and the runtime.

I tested the efficiency of the 50% return model on a large number of securities, mostly it was the majority of currency pairs.

The method of research was the following: according to the law of vibration, it doesn’t matter where we enter the market or where the security rate goes, it will always return back and will work out its 50%.

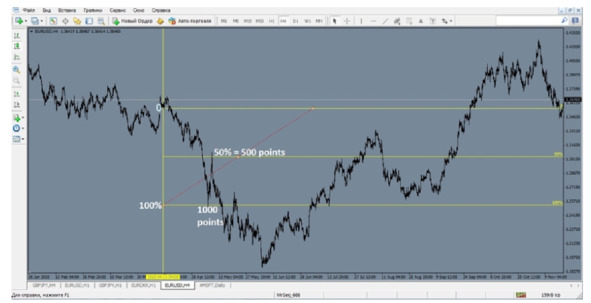

I took the currency pair EUR/USD as the example.

I simulated the date and time of entering the market with a random number generator.

– Generator shows: 13.04.2010, 4:00.

Then in order not to take into account small fluctuations, I put the filter on the minimum movement. These fluctuations will not be taken into account until the EUR/USD rate goes beyond the 300 points mark from the calculation point, these fluctuations will not be taken into account. It turned out that from that point the rate went down and beyond the 300 points mark. I was waiting for the price to return to the starting point of the calculation, 50% of the maximum distance from the starting point.

I got the following:

The rate went from the starting point of 1000 points and then turned around, reaching the expected level of 50%, in this case, it is 1000 points /2 = 500 points, the level goal of 50% return. The vibration worked as I expected.

For example:

In a similar way, a huge number of securities (more than 500, from different spheres) were tested for a different period of time (from 1 year to 12 years). Time as a vibration reference point was taken as a daily reference point 1:00 in the time zone UTC+1. As the result, all of the tested securities (currencies, shares, futures) showed 100% accuracy of the model of the law of vibration by 50% from the previous movement.

It proves again on practice that the securities markets, as well as the universe as a whole is controlled by energy, and the Law of Vibration is the basis of energy.

Now…

If we take the stock markets as self-regulatory systems (chaotic), controlled by a random process, without constant manipulation, then:

Probability of your chances to succeed in each trade is 50 to 50. In fact, if you do not know exactly where the market will go, your chances in a deal (with equal conditions) 50/50, at any time, anywhere in the market, you have the chance to win and to lose.

In terms of efficiency, the market is efficient in the third (3) highest category.

Source Wikipedia (the free encyclopedia):

“Efficient market hypothesis (EMH) states that share prices fully reflect all available information. There are three variants of the hypothesis: ‘weak’, ‘semi-strong’, and ‘strong’ form. In 1965, American economist Eugene Fama published this hypothesis and in 2003 he received The Nobel Memorial Prize in Economic Sciences. Why so late? Because all this time they were testing the hypothesis, and finally it was 100% confirmed”

All was good, but he discovered only the result, not the initial cause.

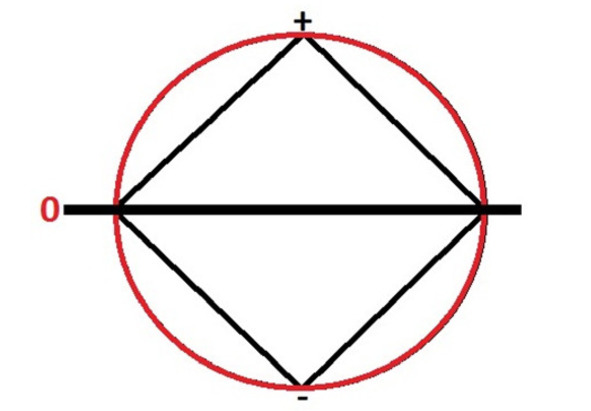

Let’s have a look at this issue: We have previously determined that all movement in the world is governed by the Law of Vibration. The model of the Law of Vibration is fundamental in energy so in the world everything is energy and everything is subject to the Law of Vibration. Fundamental position in the oscillation model

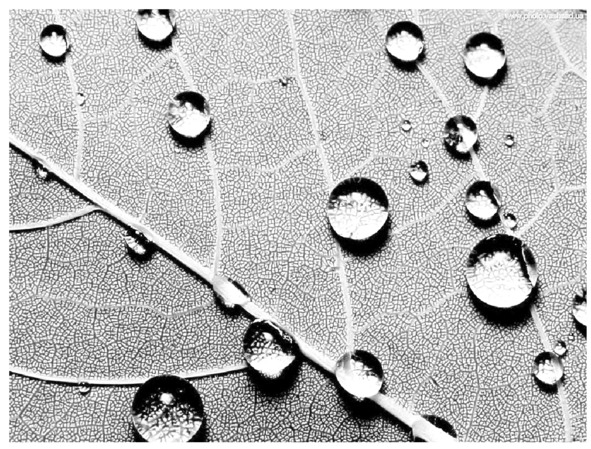

is the tendency towards equilibrium, to the zero point, to the point where this movement started, any movement (action) after the completion strives for equilibrium. We also determined that the energy has two equilibrium points: The first (1) – return to the zero point. And the second (2) – 50% return from the previous saving and vice versa. The whole nature functions on this principle, everything tends to balance and the ideal geometric form of equilibrium is a circle. The circle is an ideal form of vibration, an ideal form of equilibrium. If the living matter is not affected by another energy from the outside, it tends to take the form of a circle.

A balanced model of the law of vibration

Water drop perfectly confirms this statement

We all know that water is the most unique natural characteristics, it takes the most optimal shape of a round drop when in equilibrium.

So the man :)

Lots of examples…

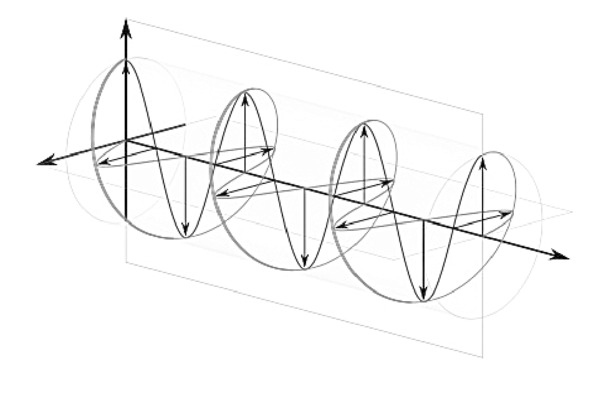

Also in nature, vibration is expressed through a spiral geometric model. Vibration has the form of a circle and carries the principle of cyclicity.

If we consider the spiral in the plane, we will see the same fundamental model of vibration:

The manifestation of the spiral shape can be found at all levels in nature, from the smallest to the largest manifestations in the galaxies form:

DNA helix

Snail shell

Spiral in nature and in the space

As you can see from the examples above, this fundamental form of energy is found everywhere in nature, in the universe, in the form of the structure of galaxies. This simple fact once again proves that everything in the universe is energy that permeates space in different frequencies and visually in different forms. And the foundation of this energy is the Law of Vibration.:)