Полная версия

The Hour Between Dog and Wolf: Risk-taking, Gut Feelings and the Biology of Boom and Bust

Settling in for the day, traders begin to call London and ask what has happened overnight. Once they have picked up the thread of the market they one by one take control of the trading books, transferring the risk to New York, where it will be monitored and traded until Tokyo comes in that evening. These traders work in three separate departments – bonds (the department is often called fixed income), currencies, and commodities, while downstairs a similar-sized trading floor houses the equity department. Each department in turn is split between traders and salespeople, the salespeople of a bank being responsible for convincing their clients – pension funds, insurance companies, mutual funds, in short, the institutions managing the savings of the world – to invest their money or execute their trades with the bank’s traders. Should one of these clients decide to do so, the salesperson takes an order from them to buy or sell a security, say a Treasury bond or a block of currencies, say dollar–yen, and the order is executed by the trader in charge of making markets in this instrument.

One of these clients, DuPont Pension Fund, livens up what is turning out to be an uneventful day by calling in the only big trade of the morning. DuPont has accumulated $750 million-worth of pension contributions from its employees, and needs to invest the funds. It chooses to do so in US Treasury bonds maturing in ten years, the interest payments from which will finance retiring employees’ pension benefits. It is still early in the day, only 9.30, and most markets are sleepy with inactivity, but the fund manager wants to execute this trade before the afternoon. That is when the Fed will announce its decision to raise or lower interest rates. Even though the financial community widely expects it to do nothing, the fund manager does not want to take unnecessary risks. Besides, for months now she has worried about what she considers an unsustainable bull market in stocks, and the very real possibility of a crash.

The fund manager scans her telephone keyboard for the four or five banks she prefers to deal with for Treasury bonds. Morgan Stanley sent her an insightful piece of research yesterday – maybe she should give them a shot. Goldman can be aggressive on price. Deutsche Bank entertains well, and last summer the salespeople covering her out of Europe took her to Henley Regatta. After a moment’s indecision she passes on these banks, and decides instead to give her pal Esmee a shot. Hitting the direct line, she says, without the usual chitchat, ‘Esmee, offer $750 million ten-year Treasuries, on the hop.’

Esmee, the salesperson, covers the speaker of her phone and yells to the trader on the Treasury desk, ‘Martin, offer 750 tens, DuPont!’

The trader shoots back, ‘Is this in competition?’ meaning is DuPont getting prices from a number of other banks. The advantage of doing a trade in competition is that DuPont ensures it gets an aggressive price; the disadvantage is that several banks would know there is a big buyer, and this may cause prices to spike before the fund gets its bonds. However, the Treasury market is now so competitive that price transparency is no longer an issue, so on balance it is probably in DuPont’s interest to keep this trade quiet. Esmee relays to Martin that the trade is ‘out of comp’, but adds, ‘Print this trade, big boy. It’s DuPont.’

Looking at his broker screens, Martin sees ten-year Treasuries quoted at 100.24–100.25, meaning that one bank, trying to buy them, is bidding a price of 100.24, while another, trying to sell, is offering them at 100.25. Traders post their prices on broker screens to avoid the tedious process of calling round all the other banks to find out which ones need to trade (in that regard a securities broker is no different from an estate agent), and also to maintain anonymity. The offer price posted right now on this broker screen is good for about $100 million only. If Martin offers $750 million to DuPont at the offered price of 100.25, he has no guarantee of buying the other $650 million at the price he sold them.

To decide on the right price, Martin must rely on his feel for the market – how deep it is, in other words how much he can buy without moving prices, and whether the market is going up or down. If the market feels strong and the offers are thinning out, he may need to offer the bonds higher than indicated on the screen, at say 100.26 or 100.27. If on the other hand the market feels weak, he may offer right at the offer side price of 100.25 and wait for the market to go down. Whatever his decision, it will involve taking a substantial risk. Nonetheless, all morning Martin has been unconsciously mapping the trading patterns on the screens – the highs and lows, the size traded, the speed of movement – and comparing them to ones stored in his memory. He now mentally scrolls through possible scenarios and the options open to him. With each one comes a minute and rapid shift in his body, maybe a slight tightening of his muscles, a shiver of dread, an almost imperceptible shot of excitement, until one option just feels right. Martin has a hunch, and with growing conviction believes the market will weaken.

‘Offer at 100.25.’

Esmee relays the information to DuPont, and immediately shouts back to Martin, ‘Done! Thanks, Martin; you’re the man.’

Martin doesn’t notice the stock compliment, just the ‘done’ part. He now finds himself in a risky position. He has sold $750 million-worth of bonds he does not own – selling a security you do not own is called ‘shorting’ – and needs to buy them. The market today may not seem much of a threat, languishing as it is, but this very lack of liquidity poses its own dangers: if the market is not trading actively, then a big trade can have a disproportionate effect on prices, and if he is not stealthy Martin could drive the market up. Besides, news by its very nature is unpredictable, so Martin cannot allow himself to be lulled into a sense of security. The ten-year Treasury bond, which is considered a safe haven in times of financial or political crisis, can increase in price by up to 3 per cent in a day, and if that happened now Martin would lose over $22 million.

He immediately broadcasts over the ‘squawk box’ – an intercom system linking all the bank’s offices around the world – that he is looking to buy ten-years at 100.24. After a few minutes a night salesman from Hong Kong comes back and says the Bank of China will sell him $150 million at 100.24. Salespeople from around the US and Canada come back with other sales, all different sizes, eventually amounting to $175 million. Martin is tempted to take the little profit he has already made and buy the rest of the bonds he needs, but now his hunch starts to pay off; the market is weakening, and more and more clients want to sell. The market starts to inch down: 100.23–24, 100.22–23, then 100.21–22. At this point he puts in the broker screen a bid of 100.215, a seemingly high bid considering the downward drift of the market. He immediately gets hit, buying $50 million from the first seller, then building up the ticket to $225 million as other sellers come in. Traders at other banks, seeing the size of the trade on the broker screen, realise there has been a large buyer and now reverse course, trying to buy bonds in front of Martin. Prices start to climb, and Martin scrambles to lift offers while he still has a profit, at higher and higher prices, first 100.23, then .24, finally buying the last of the bonds he needs at 100.26, slightly higher than where he sold them. But it is of no concern. He has bought back the bonds he shorted at 100.25 at an average price just under 100.23.

Martin has covered his bonds within 45 minutes, and made a tidy profit of $500,000. Esmee receives $250,000 in sales credit (her sales credit, a number that determines her year-end bonus, should represent that part of a trade’s profit which can be attributed to the relationship she has built with her client. You can imagine the frequent arguments between sales and trading. Like cats and dogs). The sales manager comes over and thanks Martin for helping build a better relationship with an important client. The client is happy to have bought bonds at lower levels than the current market price of 100.26. Everyone is happy. A few more days like today, and everyone can start hinting to management, even this early in the year, their high expectations come bonus time. Martin strolls to the coffee room feeling invincible, with whispered comments trailing behind him: ‘That guy’s got balls, selling $750 million tens right on the offer side.’

This scenario describes what happens on a trading floor when things go right. And in general things do not go badly wrong on a Treasury trading desk. There are certainly bad days, even months; but the really fatal events, like a financial crisis, strike at other desks. The reason is that Treasury bonds are considered to be less risky than other assets, such as stocks, corporate bonds or mortgage-backed securities. So when the financial markets are racked by one of their periodic crises, clients rush to sell these risky assets and to buy Treasuries. Trading volume in Treasuries balloons, the bid–offer spread widens, and volatility spikes. In periods like that Martin may price billion-dollar deals several times a day, and instead of making one or two cents, he may make half a point – $5 million at a crack. A Treasury desk usually makes so much money during a crisis it helps buffer the losses made on other trading desks, ones more exposed to credit risk.

There is a further reason the Treasury desk holds a privileged position on a trading floor, and that is the unrivalled liquidity of Treasury bonds. A bond is said to be liquid if a client can buy and sell large blocks of it without paying a lot in bid–offer spread and broker commissions. In normal conditions, clients can buy a ten-year Treasury at the offer side price of, say, 100.25, and sell it immediately, should they need to, a mere one cent lower. By way of comparison, corporate bonds, ones issued by companies, commonly trade with a bid–offer spread of 10–25 cents, with some trading as wide as $1 or $2. The Treasury market is the most liquid of all bond markets, and is thus perfectly tailored for large flows and fast execution, Treasury bonds being the thoroughbreds of trading instruments.

Such a market calls forth traders with a complementary set of skills. Traders like Martin must price client trades quickly, and cover their positions nimbly, before the market moves against them. This is especially true when the markets pick up speed, for then Martin has no time to think; if he is to avoid owning bonds in a falling market or being caught short in a rising one, he must price and execute his trades with split-second timing. In this his behaviour resembles not so much that of rational economic man, weighing utilities and calculating probabilities, but a tennis player at the net.

We are now going to look at Martin’s trade much as an athlete’s coach would, as a physical performance. We saw in the last chapter that our brain evolved to coordinate physical movements, and these, by the very nature of the world we lived in, had to be fast. If our actions had to be fast, so too did our thinking. As a result we came to rely on what are called pre-attentive processing, automatic motor responses and gut feelings. These processes travel a lot faster than conscious rationality, and help us coordinate thought and movement when time is short. We will look at some extraordinary research that demonstrates just how unaware we can be of what is really going on in our brains when we make decisions and take risks.

In this chapter we stray from the trading floor and visit other worlds where speed of reactions is crucial for survival, as it is in the wild and in war, and crucial for success, as it is in sports and trading. In the next chapter we look at gut feelings. These chapters provide the science we need, the background story, that will help us understand what we are seeing when, in later chapters, we head back onto the trading floor and watch Martin and his colleagues as they are swept up in a fast-moving market.

THE ENIGMA OF FAST REACTIONS

We evolved in a world where dangerous objects frequently hurtled at us at high speeds. A lion sprinting at 50 miles an hour from a hundred feet away will sink its teeth into our necks in just over one second, giving us very little time to run, climb a tree, string a bow, or even think about what to do. A spear launched in battle at 65 miles an hour from 30 feet away will pierce our chest in a little over 300 milliseconds (thousandths of a second), about a third of a second. As predator and projectile zero in, and our time to escape runs out, the speed of the reactions needed to survive shortens into a timeframe our conscious mind has difficulty imagining. Over millennia of prehistory, the difference between someone who lived and someone who died often came down to a few thousandths of a second in reaction time. Evolution, like qualifying heats at the Olympics, took place against the sustained ticking of a stopwatch.

Things are not that different today, in sport, for example, or war, or indeed in the financial markets. In sport we have sharpened the rules and honed the equipment to such an extent that once again, as in the jungle, we have pushed up against our biological speed limits. A cricket ball bowled at 90 miles an hour covers the 22 yards to the batsman’s wicket in about 500 milliseconds; a tennis ball served at 140 miles an hour will catch the service line in under 400 milliseconds; a penalty shot in football will cover the short 36 feet to the goal in about 290 milliseconds; and an ice hockey puck shot halfway in from the blue line will impact the goalie’s mask in less than 200 milliseconds. In each of these cases, the less than half a second travel time of the projectile gives the receiving athlete about half that time to make a decision whether or not to swing the bat, or return the serve, or jump to the left or right, or reach for the puck, for the remaining time must be spent initiating the muscle or motor response.

Even these short timeframes do not capture the truly miraculous speeds frequently demanded of the human body. In table tennis, which many of us consider a leisurely pursuit, the ball when smashed travels at 70 miles an hour, yet the distance between players may be only 14 to 16 feet, giving the returning player about 160 milliseconds to react. The difference between winning and losing has been shaved to a few thousandths of a second in reaction times. Similar reaction times are found in sprinters, who are so fast off the blocks, reacting to the starting gun in a little over 120 milliseconds, with some even approaching the 100-millisecond mark, that races increasingly feature what are called silent guns. These starting pistols produce a bang which is heard from electronic speakers placed behind each runner so that they all hear the starting signal at the same time. Without these speakers the runners in the outside lanes would hear the pistol with a fatal 30-millisecond delay, that being about the time it takes the sound of the shot to reach them.

Or consider one of the most dangerous positions in the sporting world, the close fielder in cricket. On a cricket field, this brave soul plants himself, crouched at the ready, a mere 14 to 17 feet from the batsman, with some coming in even closer than that. Here, without the benefit of gloves, he attempts either to catch the ball as it explodes off the bat, or to get out of the way. A cricket ball, slightly larger than a baseball and much harder, rebounds off a swinging bat at speeds of up to 100 miles an hour. The fielder facing this ball must first take care not to be hit by the bat itself, and then has as little as 90 milliseconds, less than a tenth of a second, to react to the incoming projectile. One of the closest of these positions is appropriately called silly point, and in here, this close to the batsman, death can occur. One Indian player, Raman Lamba, was killed by a ball to the temple while he was fielding at short leg, another position frighteningly close to the batsman.

Equally deadly projectiles, ones responsible for far more injuries, can be found in contact sports like karate and boxing, where punches have been clocked at terrifying speeds. Norman Mailer, reporting on the Rumble in the Jungle, when Muhammad Ali fought George Foreman in the Zairean capital Kinshasa in 1974, describes Ali warming up in the ring, ‘whirling away once in a while to throw a kaleidoscope-dozen of punches at the air in two seconds, no more – one-Mississippi, two-Mississippi – twelve punches had gone by. Screams from the crowd at the blur of the gloves.’ If Mailer’s numbers are right, one of Ali’s punches would run its course from beginning to end in about 166 milliseconds, although Foreman would only have had half that time to avoid it. In fact, later, more scientific measurement timed Ali’s left jab at little more than 40 milliseconds.

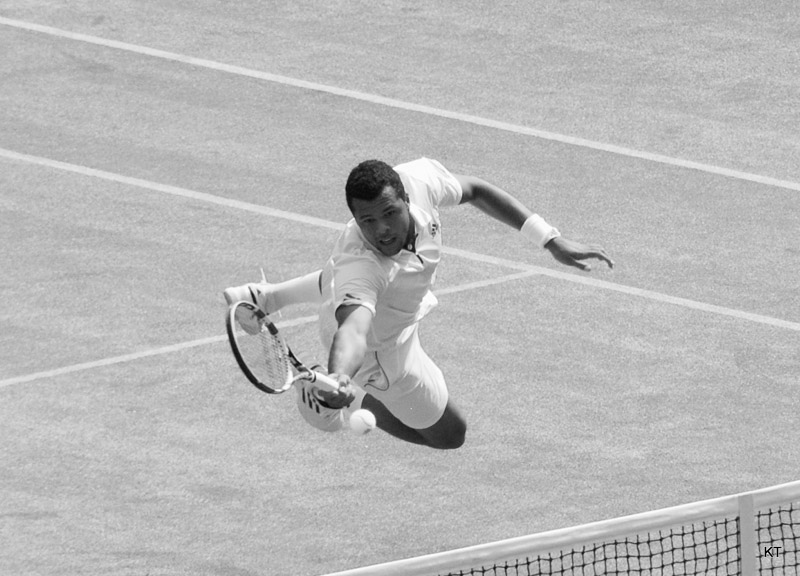

Fig. 4. Speed of reactions. Jo-Wilfried Tsonga reaching for a volley at Wimbledon, 2011. If we assume his opponent, Novak Djokovic, hit a backhand from the baseline at about 90 mph, then Tsonga had a little over 300 milliseconds to respond.

It should come as no surprise that athletes facing fast-moving objects like cricket balls or ice hockey pucks frequently fail to intercept them (or in boxing to avoid them). But if an athlete succeeds, say, one time out of three, as a good baseball player does when at bat, his success rate approaches that of many predators in the wild. A lion, for example, closing in on an antelope, or a wolf on a deer, catches its prey on average one time out of three. In sport, as in nature, competition has pushed reaction times right to the frontier of the biologically possible.

Unfortunately, those of us not gifted with the reaction times of an Olympic athlete are nonetheless often called upon to respond with something like their speed, especially while on the road. A driver speeding at 70 miles an hour has as little as 370 milliseconds to avoid a car 75 feet in front that has mistakenly swerved into the oncoming lane. Here a success rate of one out of three still leaves a lot of car crashes.

The speed demanded of our physical reactions, in the wild, in sports, on the road, even in the financial markets, raises troubling questions when lined up against certain findings in neuroscience. Take this curious fact, for instance: once an image hits the retina, it takes approximately 100 milliseconds – that is a full tenth of a second – before it consciously registers in the brain. Pause for a moment and contemplate that fact. You will soon find it profoundly disturbing. We tend to think, as we survey the world around us or sit in the stands of a sporting match, that we are watching a live event. But it turns out that we are not – we are watching news footage. By the time we see something, the world has already moved on.

The trouble stems from the fact that our visual system is surprisingly slow. When light hits our retina, the photons must be translated into a chemical signal, and then into an electrical signal that can be carried along nerve fibres. The electrical signal must then travel to the very back of the brain, to an area called the visual cortex, and then project forward again, along two separate pathways, one processing the identity of the objects we see, the ‘what’ stream, as some researchers call it, and the other processing the location and motion of the objects, the ‘where’ stream. These streams must then combine to form a unified image, and only then does this image emerge into conscious awareness. The whole process is a surprisingly slow one, taking, as mentioned, up to one tenth of a second. Such a delay, though brief, leaves us constantly one step behind events.

Neuroscientists have discovered another problem with the idea that we are watching the world live. An important part of this idea is the notion that our eyes objectively and continuously record the scene before us, much like a movie camera. But eyes do not operate like this. If we continuously recorded the visual information presented to us, we would waste a great deal of time (and probably suffer constant headaches) looking at blurred images as our eyes pan from one scene to another. More importantly, we would be swamped by the sheer amount of data, most of which is irrelevant to our needs. Live streaming takes up an enormous amount of bandwidth on the internet, and it does so as well in our brains. To avoid a needless drain on our attentional resources, our brain has hit upon the tactic of sampling from a visual scene, rather than filming it. Our eyes fix on a small section of our visual field, take a snapshot, then jump to another spot, take a snapshot, and quickly jump again, much like a hummingbird nervously flitting from flower to flower. We are largely unaware of this process, and do not see a blur when our eyes shift location because, remarkably, the visual system stops sending images up to consciousness while it jumps from scene to scene. Furthermore, we are unaware of these jumps and intervening blackouts because our brain weaves these images seamlessly into something that does appear much like a movie. We can perform up to five of these visual jumps per second, the minimum amount of time required for a shift in view being therefore one fifth of a second.

If we return to sports, we can see that some numbers do not add up. How can a cricketer at silly point catch (or duck) a ball in under a tenth of a second if he is not even aware of it yet? How can he direct his attention to the ball if it takes him twice as long just to move his eyes? And when dealing with these numbers we have not even begun to consider the additional 300–400 milliseconds required for an elementary cognitive decision or inference, and the 50 milliseconds or so it takes for a motor command to be communicated by nerves to our muscles. The picture conjured by these numbers is one of an infielder frozen in the readiness stance, eyes fixed like a waxwork model, while a projectile shudders past his immobile and fragile head.

The same questions we ask about athletes can be asked, and with more urgency, beyond the cricket pitch. How can we humans survive in a brutal and fast-moving world if our consciousness arrives on the scene just after an event is over? This is a baffling question. But asking it allows us to see what is wrong with the notion of the brain as a central processor, taking in objective information from the senses in the manner of a camera, processing this information rationally, consciously and discursively, deciding on the appropriate and desired action, and then issuing motor commands to our muscles, be they larynx or quadriceps. Each of these steps takes time, and if we were indeed programmed to behave this way, then life as we know it would be very different. If we had to think consciously about every action we took, sporting events would become odd, slow-motion spectacles that few people would have the patience to watch. Worse, in nature and in war we would have long ago fallen prey to some quicker beast.

I, CAMERA?

It turns out that there is something wrong with each step in this supposed chain of mental events. The eye takes snapshots rather than movies; but even these snapshots are not a photographic and objective record of the outside world. All sensory information comes to us tampered with. Like the news on TV, it is filtered, warped and pre-interpreted in a way designed to catch our attention, ease comprehension and speed our reactions.

Take for instance the ways in which the brain deals with the problem of the one-tenth-of-a-second delay between viewing a moving object and becoming consciously aware of it. Such a delay puts us in constant danger, so the brain’s visual circuits have devised an ingenious way of helping us. The brain anticipates the actual location of the object, and moves the visual image we end up seeing to this hypothetical new location. In other words, your visual system fast-forwards what you see.

An extraordinary idea, but how on earth could we ever prove it to be true? Neuroscientists are devilishly clever at tricking the brain into revealing its secrets, and in this case they have recorded the visual fast-forwarding by means of an experiment investigating what is called the ‘flash-lag effect’. In this experiment a person is shown an object, say a blue circle, with another circle inside it, a yellow one. The small yellow circle flashes on and off, so what you see is a blue circle with a yellow circle blinking inside it. Then the blue circle with the yellow one inside starts moving around your computer screen. What you should see is a moving blue circle with a blinking yellow one inside it. But you do not. Instead you see a blue circle moving around the screen with a blinking yellow circle trailing about a quarter of an inch behind it. What is going on is this: while the blue circle is moving, your brain advances the image to its anticipated actual location, given the one-tenth-of-a-second time lag between viewing it and being aware of it. But the yellow circle, blinking on and off, cannot be anticipated, so it is not advanced. It thus appears to be left behind by the fast-forwarded blue circle.